Schedule a Call Back

The future of compressed air business

Technical Articles

Technical Articles- May 02,18

_.gif)

- Life cycle cost: The customer needs to be aware of a compressor’s lifecycle cost, which includes the initial machine cost, energy consumption, spares and maintenance cost, and the revenue loss from a downed compressor. The largest portion is the power cost. Thus, manufacturers need to tackle the challenge of continuous improvement in compressor efficiency.

- Oil-free air: The majority of of compressors use oil while generating compressed air, placing a burden on the environment. The current oil free compressors are expensive and inefficient, and are thus relegated to applications such as the pharmaceuticals and food manufacturing industries. Thus, the challenge for a manufacturer is to develop a system that produces oil free air at the efficiency and cost of a lubricated screw compressor.

- Uptime reliability: Reliability is an often overlooked attribute. Specifically, customers focus on the cost of parts and service in the event of a breakdown, but the larger cost derives from the cost of lost production. Thus, customers should assess the products’ track record of reliability and the manufacturer’s ability to restore air in the event of a breakdown. Technology offers a solution to minimize the cost of downtime. Soon, machines will be launched with data transmission capabilities that will allow engineers to monitor compressor health across parameters such as temperature, pressure loss, etc. and thus prevent machine failures.

Related Stories

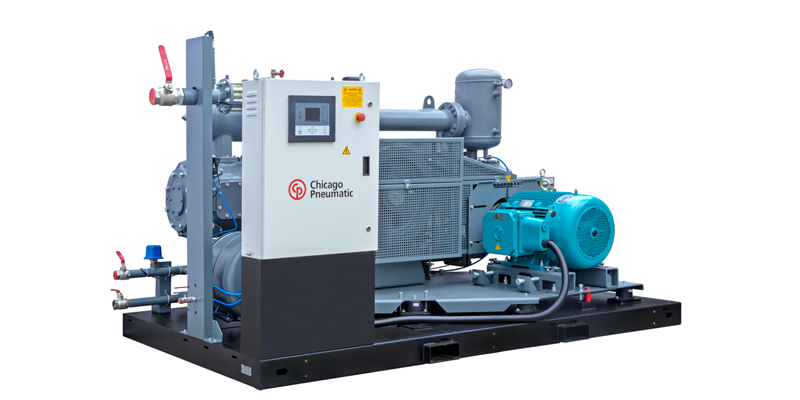

Top eight maintenance tips to extend the lifespan of reciprocating compressors

In this article, Siddhartha Guin, Business Line Manager (CTS), Chicago Pneumatic Compressors, India, shares essential maintenance practices to help extend the lifespan of these vital machines. From ..

Read more

Danfoss Acquires Palladio Compressors to Enhance Global Portfolio

The integration of Palladio's screw compressors with the existing technologies of Danfoss promises competitive and advanced high-temperature solutions.

Read more

Ingersoll Rand aims to double India business in the next 5 years: Sunil Khanduja

In this interview, Sunil Khanduja, MD, Ingersoll Rand India, emphasises that the company is committed to India while supporting the country’s green and digital industrial transformation.

Read moreRelated Products

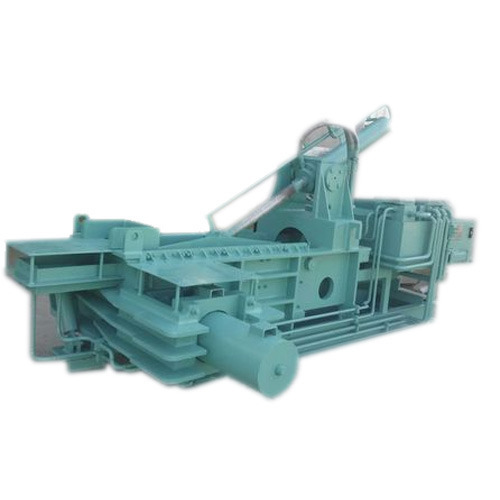

Baling Machine

Mask Hydraulic Machineries provide triple action scrap baling machines. Read more

Manifold Block

Om Shakthi Hydraulics offers a wide range of hydraulic manifold blocks. Read more

Exclusive Hydraulic Fittings

Supreme Engineers is engaged in manufacturing and supplying an exclusive range of hydraulic fittings. Read more