Schedule a Call Back

Steel industry: Long products marching ahead

Technical Articles

Technical Articles- Sep 01,18

Related Stories

Resilience in Metal: Forging the Make in India Future in a VUCA World

The article examines how India’s stainless steel sector can turn global volatility, CBAM and supply risks into strategic advantages through sustainability, quality enforcement and digital transfor..

Read more

Steel Sector Holds the Key to India’s Manufacturing Resilience

India’s steel sector is emerging as a strategic pillar in strengthening manufacturing resilience amid global volatility, supporting infrastructure growth, self-reliance, and long-term industrial c..

Read more

Danfoss, PowerNEU Launch JV to Drive Decarbonisation in Metals Sector

New Danfoss PowerNEU JV in Jamshedpur strengthens local execution and decarbonisation solutions for India’s metals industry.

Read moreRelated Products

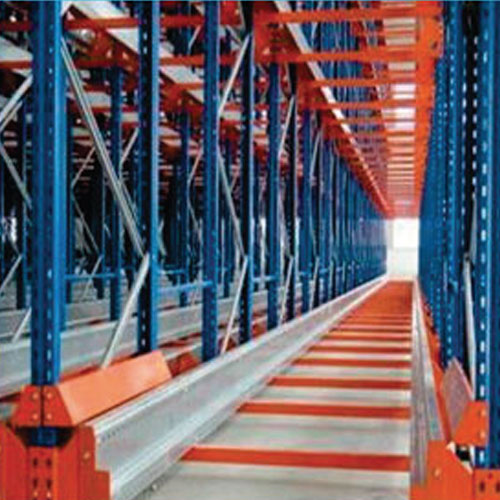

Pallet Shuttle Racking

SCI Storage Solution offers a wide range of pallet shuttle

racking.

Gravity Flow Pallet / Shelving Racking

SCI Storage Solution offers a wide range of gravity flow

pallet / shelving racking.

Auto Transformer

HCS Power Ventures Pvt Ltd offers Auto Transformer. Servottam Autotransformer is an electrical transformer with only one winding. The "auto" prefix refers to the single coil acting on itself and no Read more