Schedule a Call Back

Privatisation of coal mining to boost production

Technical Articles

Technical Articles- Jul 01,18

Opening up the coal sector for private commercial mining is expected to benefit in the medium to long-term, says Jayanta Roy.

India’s coal demand-supply balance still remains tilted in favour of coal imports as the state-run miners, Coal India and the Singareni Collieries Company have been unable to entirely meet India’s coal demand, especially for higher grade thermal coal/washed coal and coking coal. The country’s coal imports remain high, accounting for around 24 per cent of the present domestic demand. This high import dependence is because of the fact that as against a compounded annual growth rate of 5.6 per cent in domestic coal demand during the XIIth Five Year Plan ended March 31, 2017, India’s coal production has grown at a slower pace at 4.5 per cent during this period.

The track-record of private sector captive miners in ramping up domestic coal output has not been very encouraging, with production levels remaining range-bound between 40-60 mtpa in the last several years, and accounting for a paltry 6-10 per cent of the overall domestic production. Long delays in getting regulatory approvals, challenges in land acquisition, and infrastructure deficits have often emerged as key reasons for the limited growth in India’s captive coal mining, further adding to the domestic coal supply deficit. Figure 1 shows the trend in domestic coal production and share of imports.

A welcome move

Seen in this context, the Ministry of Coal’s Mining Policy circular issued in February 2018 is a welcome development from the coal user’s perspective. The ministry has come out with the methodology for auction of coal mines for private commercial mining, and has allowed 100 per cent foreign direct investment (FDI), clearing the path for the entry of global commercial coal miners to India.

The benefits of the new policy are manifold. It will enable to create an efficient and competitive coal market. Commercial miners can now participate in coal mine auctions. The potential market opportunity for private commercial miners would include the partial substitution of India’s 160 million tonne per annum (mtpa) thermal coal imports, getting a share of the 100 mtpa e-auction market, and meeting a part of the 165 mtpa incremental domestic coal demand to be created in the next five years. However, for the 432 mt of coal supplies, which Coal India sells through long term fuel supply agreements (FSAs), possibility of customers switching over to commercial miners looks unlikely at the moment, especially given the cross-subsidisation model followed by the Central Miner for delivery of cheaper coal to the power plants.

India’s coal import basket in FY2017 comprised 149.3 mt (in FY2018, India’s thermal coal imports is expected to increase to around 160 mt) of thermal coal imports and 41.6 mt of coking coal imports. Within the thermal coal import basket, ~19.8 mt was imported by power plants designed on domestic coal. For power plants designed on low-ash imported coal, approximately 46.3 mt was imported during FY2017. The balance 83.3 mt was imported by the non-regulated sector, which would be a mix of both high calorific value coal (~5,500-6,000 kcal/kg GCV used in cement and sponge iron kilns), and low calorific value coal (~3,500-4,500 kcal/kg used in captive power generation). For the 149.3 mt of thermal coal imports, private commercial miners have an opportunity to cater to the demand of customers dependent on imports by supplying low calorific value coal to captive power plants or power plants based on domestic coal, and supplying low-ash high calorific value coal to the cement and steel sectors, which can either be through supply of high grade coal or washed coal.

India already has a mechanism for market price discovery of coal through e-auctions. In FY2017, Coal India sold around 92 mt of coal through the e-auction route, which represents around 17 per cent of the miner’s overall despatches. Given that customers from both the regulated and non-regulated sectors are willing to pay a premium to get the desired quality of coal from auctions, private commercial miners can potentially vie to get a share of the opportunity that exists in the e-auction market, where coal is sold at a substantial premium to the notified prices.

Benefits to equipment players

Going forward, the new policy, which will help increase India’s domestic coal production, can create new opportunities for equipment players. The enabling clause allowing 100 per cent FDI in commercial coal mining is likely to open the doors for global coal miners to invest in India. This can benefit the sector through increased technology adoption and mechanisation in mining operations, creating new avenues for growth for equipment players.

However, given the long lead time to start mining operations due to issues related to land acquisition and regulatory clearances for any mining project, coal production from private commercial miners is unlikely to increase significantly in the near term, and therefore the benefits to equipment players would only be visible on the medium to long term.

Critical factors for success

Other factors that will be critical for the success of private commercial mining include:

The size of mines being offered: Smaller mines would mean higher costs

Infrastructure preparedness: Mines having supportive infrastructure, leading to ease of coal evacuation can incentivise private miners to participate

Geological challenges in mining: Opencast mines having unfavourable stripping ratios would adversely impact cost competitiveness, and in turn dampen prospects for private sector participation

Land acquisition: Mines located in proximity to human habitation increases risks associated with rehabilitation and resettlement (R&R) and in turn project delays, and

Timely regulatory clearances: A supportive mining ecosystem enabling timely clearance of regulatory permits can minimise friction to business, and would be critical for encouraging a wide private sector participation in the commercial limitation to switch to domestic coal

Production to take time

Nevertheless the opening up of the coal mining sector to private sector participation would result in faster ramp up of coal production, helping gradually reduce India’s import dependence, especially for thermal coal. However, details pertaining to the coal blocks and their reserves are not yet available, and the success of the recent guidelines would critically hinge on the nature of coal blocks offered and typical risks pertaining to mining projects including regulatory risks (environment and forest clearances) and issues related to land acquisition. As a result, coal production from commercial coal mining is not likely to be significant in the next couple of years at least.

About the author: Jayanta Roy is the Senior Vice President and Group Head - Corporate Ratings of ICRA.

Table 1: Impact of new guidelines on coal mining

| Only forward auction |

Related Stories

Engineering India’s Next Phase of Growth with Responsibility: Amit Sharma

Amit Sharma, MD and CEO, Tata Consulting Engineers (TCE), outlines TCE's strategy to support India’s next phase of industrial growth through integrated engineering, nuclear and digital capabilitie..

Read more

EV transition and tariff wars redefine India’s auto components play

India’s auto component industry is poised to hit $ 145 billion by FY30 from $ 80 billion in FY25. Yet high US tariff, EV transition and heavy reliance on imports from China expose vulnerabilities,..

Read more

The role of risk management in large projects

Risk is inseparable from project management, particularly in large and long-duration projects, where inadequate risk identification, ownership and follow-up often lead to cost and time overruns. Pra..

Read moreRelated Products

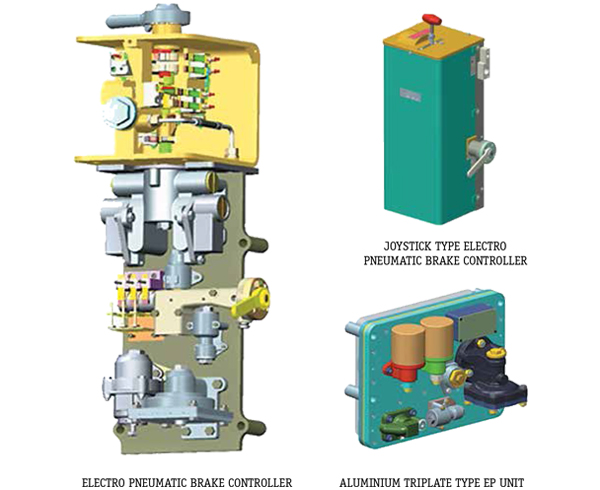

Electro - Pneumatic Brake System for Emu

Escorts Kubota Limited offers a wide range of electro - pneumatic brake system for EMU.

Indef Powered Crane Kit

Hercules Hoists Ltd offers a wide range of Indef powered crane kit.

Jib Crane

DC Hoist & Instruments Pvt Ltd offers a wide range of Jib crane.