Schedule a Call Back

Machine tools sector to achieve efficiency with smart systems

Technical Articles

Technical Articles- Jan 01,20

Related Stories

Phillips Opens Expertise Centre in Pune to Boost Manufacturing Innovation

New Chakan facility to promote advanced, smart and sustainable manufacturing

Read more

Seco redefines tool management with reconditioning and digital traceability

In addition to remanufacturing services, Seco operates a recycling program for carbide tools. When tools are too worn for remanufacturing, they are responsibly recycled into new products.

Read more

Boehlerit’s THETAtec 25N Feed tool system redefines high feed milling

High performance cutting brings productivity increases and measurable cost reductions at the same time. With the new THETAtec 25N Feed, Boehlerit now offers another high-end tool system for this mac..

Read moreRelated Products

Precision Cutting Tools1

S S Trading Corporation offers a wide range of precision

cutting tools.

Slotting Head Unit for All Cnc Turn Mill Centers

Sphoorti Machine Tools Pvt Ltd offers a wide range of

slotting head unit for all CNC turn mill centers.

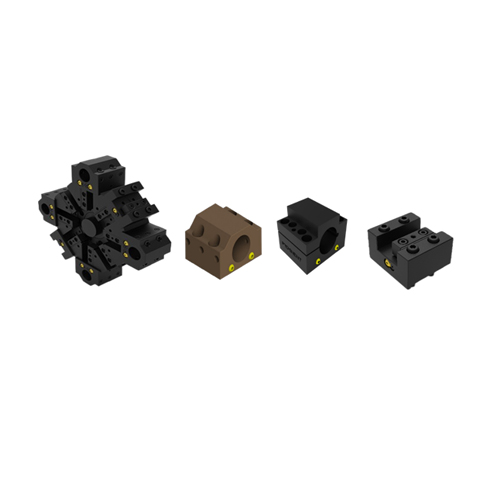

Slotted Tool Disc and Tool Holders

Prominent Machine Tools offers a wide range of slotted tool disc and tool holders.