Schedule a Call Back

Indian solar sector raises $10 billion in financing in 2017

Technical Articles

Technical Articles- Apr 01,18

Solar funding grew last year as approximately 9.6 GW of new solar installations were added to the Indian grid, says a Mercom Capital Group report.

In 2017, the Indian solar sector logged over $ 10 billion (approximately Rs 650 billion) in financing activity, according to Mercom Capital Group’s recently released 2017 Q4 and Annual India Solar Market Update. By comparison, financing activity in the sector totaled approximately $ 4 billion (about Rs 260 billion) in 2016.

Project financing in 2017 rose to about $ 6.4 billion (ie, Rs 416 billion) on the back of 9.6 GW in solar installations, compared to $ 3.5 billion (Rs 228 billion) in financing activity when 4 GW of solar was installed in 2016.

Corporate funding (VC/PE, public market, and debt) raised by Indian solar companies in 2017 totaled $ 3.6 billion (about Rs 235 billion) and accounted for approximately 28% of the global total. In terms of venture capital and private equity investments, Indian companies raised over $ 800 million (Rs 52 billion) and accounted for about 50% of the global total. Graph 1 indicates corporate funding for Indian solar companies.

The increase in corporate funding in 2017 was largely spurred by large private equity deals. The biggest of these deals was announced by ReNew Power, which closed two deals worth $200 million (Rs 13 billion) each. A host of other companies announced their own deals worth more than $100 million (Rs 6.5 billion), including Greenko Energy, Hero Future Energies, and CleanMax Solar. Graph 2 shows VC-PE funding received by Indian solar companies in 2017.

Debt financing was another area that saw significant year-over-year growth. Most of the debt activity among Indian solar companies came in the form of new bonds. Greenko Energy issued senior notes and bonds to the tune of $1.5 billion (Rs 98 billion), Azure Power raised over $500 million (Rs 33 billion) through a bond, and ReNew Power also raised close to $500 million (Rs 33 billion) via bond issues. The debt instruments used to raise financing in 2017 were numerous, and included senior notes, bonds, non-convertible debentures, and a flexi-line of credit. Interest rates for various instruments ranged from 4.9% to 8.75%.

There were no corporate M&A deals in the solar sector during 2017. Project acquisition activity fell by half in terms of dollars compared to 2016. The largest project acquisition deals included the $600 million (Rs 39 billion) acquisition of Hindustan Power Projects’ 330 MW solar portfolio by the Macquarie Group and the $300 million (Rs 19.6 billion) acquisition of First Solar’s 190 MW project portfolio by IDFC Alternatives. By comparison, 2016 acquisition activity was dominated by the $1.4 billion (Rs 91 billion) purchase of Welspun Renewable Energy’s 1.1 GW project pipeline by Tata Power Renewable Energy.

Q4 2017 Highlights

ReNew Power Ventures - an Indian renewable energy project developer - secured approximately $200 million (Rs 13 billion) from the Canada Pension Plan Investment Board in the form of compulsory convertible preference shares (convertible debt) that will convert to equity shares at the time of an initial public offering. Table 1 indicates top 5 Indian VC-PE funded solar companies in 2017.

Waaree Energies, an Indian solar module manufacturer and EPC services provider, raised Rs 1 billion ($15.6 million) from Centrum Financial Services, the non-banking finance arm of the Centrum Group and a private equity (PE) firm. The funding will be used for its expansion plans.

Indian rooftop solar developer CleanMax Solar raised a $15 million (Rs 980 million) investment from the International Finance Corporation (IFC) in the form of compulsorily convertible debentures. The investment marks the first time that IFC has purchased equity shares in a distributed-generation firm.

Debt financing

Azure Power completed a $500 million (Rs 32.6 billion) green bond offering that is set to mature in 2022. It was the first solar green bond to be offered by a company that only has solar power assets located in India. The funds will be used to refinance existing debt and for other general corporate expenses. The joint global coordinators for the offering were Barclays, HSBC, and JP Morgan. They also acted as joint bookrunners with Credit Suisse, Deutsche Bank, and Societe Generale. Latham & Watkins represented the joint coordinators and bookrunners in the offering. Table 2 shows top five Indian funding in 2017 in solar.

Greenko raised Rs 30 billion ($461 million) through the sale of onshore rupee-denominated bonds. The 10-year bonds mature in 2027 and carry a coupon rate of 8.75%. The bonds have a call option after five years and pay interest semi-annually. Greenko made the sale through its special purpose vehicles that operate solar projects in India. JP Morgan Chase arranged the offering for Greenko’s SPVs.

Project acquisitions

Canadian Solar, a solar project developer and vertically integrated solar module manufacturer, sold its 108 MW grid-connected solar project in the Indian state of Maharashtra. Canadian Solar won the bid to develop the 108 MW grid-connected solar project by participating in a 450 MW solar tender held by Solar Energy Corporation of India (SECI) under the Viability Gap Funding (VGF) program under the National Solar Mission (NSM) Phase-II, Batch-IV, Tranche-III. The project has a 25-year PPA with SECI.

IPOs

SEBI approved ACME Solar Holdings’ plans to hold an IPO worth Rs 22,000 million ($ 336.86 million). The face value of each equity share is Rs 10 ($0.15) and they will be up for grabs on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). In total, 2,200 million equity shares will be up for trade. In October 2017, ACME Solar Holdings filed a draft red herring prospectus with SEBI.

“Currently, we are forecasting investments in the solar sector to slow down along with installations in 2018. Uncertainties created by trade cases with possible safeguard and anti-dumping duty imposition will have a direct negative impact on investments unless the government acts fast to resolve these issues in a way that creates confidence among the investment community,” concluded Raj Prabhu, CEO of Mercom Capital Group.

Table 1: Top 5 Indian VC-PE funded solar companies in 2017

| Company | Amount | Investors |

| ReNew Power Ventures | $ 200 mn | Canada Pension Plan Investment Board |

| ReNew Power Ventures | $ 200 mn | JERA (JV of Tokyo Electric Power and Chubu Electric Power) |

| Greenko Energy | $155 mn | GIC, Abu Dhabi Investment Authority (ADIA) |

| Hero Future Energies | $125 mn | International Finance Corporation (IFC) |

| CleanMax Solar | $100 mn | Warburg Pincus |

Source: Mercom Capital Group

Table 2: Solar top 5 Indian funding in 2017

| Company | Funding Type | Amount | Investors |

| Greenko Energy | Bond Issue (Green Bonds) | $650 mn | Barclays, Deutsche Bank, Investec, JP Morgan, Morgan Stanley, Fidelity, Goldman Sachs, Blackrock |

| Azure Power | Bond Issue (Green Bonds) | $500 mn | |

| ReNew Power | Green Bonds | $475 mn | |

| Greenko Energy | Bond Issue | $461 mn | |

| ReNew Power | Project Financing | $390 mn | Asian Development Bank (ADB) |

Source: Mercom Capital Group

Related Stories

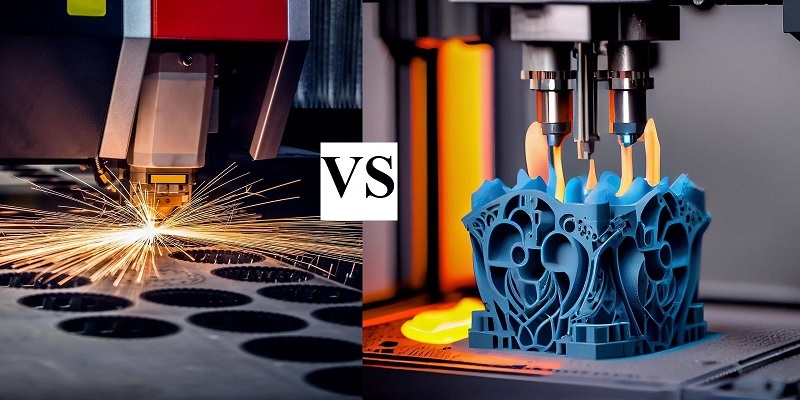

Intersection of 3D printing and laser cutting: A new paradigm in manufacturing

The intersection of 3D printing and laser cutting remains a niche area. However, it should gain prominence when people learn about use cases that demonstrate versatility and viability, says Emily Ne..

Read moreJindal Aluminium produces 115,920 MT of aluminium extruded products in FY23-24

Operating three cutting-edge manufacturing plants located in Bengaluru, Dabaspet (Karnataka), and a newly acquired facility in Bhiwadi (Rajasthan), Jindal Aluminium boasts a total manufacturing capa..

Read more

Zoho plans $700 million foray into chip manufacturing; compound semiconductors

Semiconductors occupy a pivotal position in India's economic agenda, with the government implementing a $10 billion package to fortify the industry's capabilities, positioning the nation to rival es..

Read moreRelated Products

Power Conversion Systems

POM Systems & Services Pvt Ltd offers a wide range of

PCS power conversion systems energy storage.

Hot Water Generators

Transparent Energy Systems Private Limited offers a wide range of Hot water generators - Aquawarm Superplus.

Scrap Baling Press

Fluid Power Machines offers hydraulic scrap baling press. Read more