Schedule a Call Back

Fluid power market witnessing spur in demand

Technical Articles

Technical Articles- Nov 01,17

Related Stories

SIT plans to introduce new power transmission solutions in India: Amit Nangre

In this interview, Amit Nangre, Executive Director, SIT PTC India Pvt Ltd, shares insights on the company’s growth journey, challenges, and future opportunities.

Read more

India’s specialty chemicals sector gears up for global transition

India’s specialty chemicals industry is transitioning from a fragmented, domestic-focused market to a global hub, supported by policy reforms, R&D investment, and rising export opportunities. Dr A..

Read more

India’s Automotive Sector Amid Global Uncertainty

The automotive industry is both an engine of growth and a bellwether of India’s global competitiveness. However, the industry needs to build up a strategic roadmap for global success, writes Jupit..

Read moreRelated Products

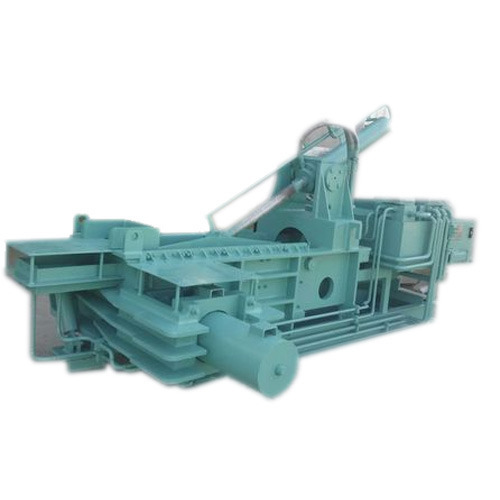

Baling Machine

Mask Hydraulic Machineries provide triple action scrap baling machines. Read more

Manifold Block

Om Shakthi Hydraulics offers a wide range of hydraulic manifold blocks. Read more

Exclusive Hydraulic Fittings

Supreme Engineers is engaged in manufacturing and supplying an exclusive range of hydraulic fittings. Read more