Schedule a Call Back

Rising hygiene need drives demand for sanitary pumps

Articles

Articles- May 27,23

Increase in stringent regulations with respect to hygiene in industries such as food and beverage (F&B), healthcare, pharmaceuticals, etc is driving the requirements for sanitary pumps. According to Technavio, the global sanitary pumps market is estimated to increase by $ 560.15 million between 2022 and 2027, at a CAGR of 4.33 per cent.

The need for a high level of cleanliness and hygiene is the major reason for the adoption of sanitary pumps in the F&B industry. In the last few years, regulations in the food and beverage industry have become stringent as regulatory bodies are imposing new hygiene and sanitary standards. Regulations have become more stringent in developed regions like North America and Europe, where various government organisations and associations demand the highest level of quality and safety from F&B manufacturers. Moreover, consumers are also moving toward organic food, which has provided new growth avenues for the market in the food and beverage industry. This is expected to drive the growth of the market in the future.

The versatility of air-operated, double-diaphragm pumps makes them suitable for sanitary applications in the food and beverage, paints and coatings, and ceramics industries. In the food and beverage industry, sanitary air-operated, double-diaphragm pumps can handle highly viscous fluids such as chocolates as well as materials with solid substances such as soups. These pumps can also be used in the water and wastewater industry as run-dry without electricity, which makes them suitable for wet conditions.

Sanitary air-operated, double-diaphragm pumps find application in the cosmetic industry also, wherein they are used for handling various types of viscous materials that are used in combination with several products. Furthermore, air-operated, double-diaphragm pumps require minimal maintenance and services for repair and less cleaning up. Thus, the adoption of air-operated, double-diaphragm pump technology is one of the growing trends, which is expected to drive the growth of the market during the forecast period.

Volatility in raw material prices is the major challenge impeding market growth. Pump production requires several raw materials, such as steel, cast iron, brass, and bronze. These commodities are globally traded and, therefore, are highly vulnerable to price fluctuations. Among all the raw materials, steel and aluminum comprise the highest share as these are used as the construction material in pump components, body frame, and the motor that drives the pump.

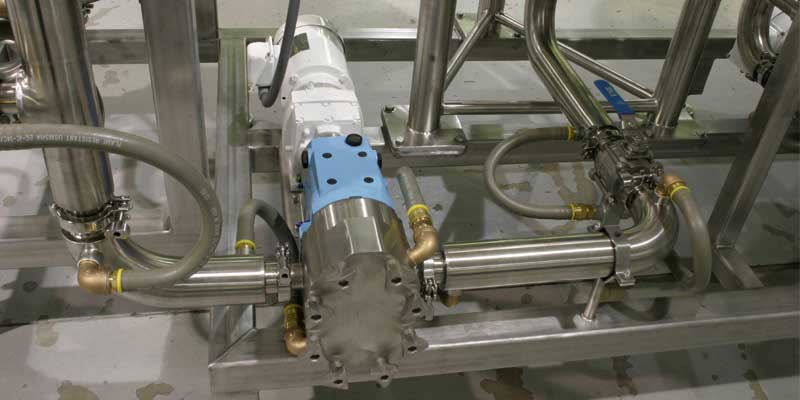

Sanitary pumps mainly use Stainless Steel 316 grade as they can withstand high temperatures, and the protective oxide layer aids in preventing the formation of rust, which can contaminate food products. This makes Stainless Steel 316 grade suitable for use in the food and beverage and healthcare industries.

Fastest-growing segment

The market share growth of the kinetic sanitary pumps segment will be significant during the 2022-2027 period. These pumps also referred to as "dynamic" or "rotodynamic," are made to convey fluids by introducing kinetic energy into them. These pumps may transfer less-viscous liquids more effectively than other types of pumps because they are easier to accelerate using kinetic energy. For applications requiring exceptionally high output pressures, multi-stage variants are available, and they have very high flow rates with constant, non-pulsing flow, hence are in demand.

The kinetic sanitary pumps segment was valued at $ 11.184 billion in 2017 and continued to grow until 2021. In processing applications, a kinetic pump often has a very specialised function. It is made to pump fluids that contain entrained air or gases without losing their prime, which a typical centrifugal pump finds challenging. A liquid ring pump is a fantastic option for a clean-in-place (CIP) return pump in high-purity processing applications because of this design element.

Asia Pacific (APAC) was the highest contributing region to the market in 2022, owing to the high demand for sanitary pumps from the food and beverage, pharmaceutical, and semiconductor industries. Small and medium business enterprises are also increasingly adopting sanitary pumps to compete with international vendors. The food and beverage industry will witness high growth in APAC as the market provides significant opportunities for vendors owing to the large population and increasing urbanisation.

Source: Technavio

Related Stories

Vipul Organics forays into membrane manufacturing

The company will build a separate facility for membrane manufacturing at its greenfield project at Saykha, Gujarat.

Read more

Avians High-Speed Clean Room Doors: Advancing Contamination Control

Avians high-speed clean room doors are redefining contamination control in sensitive environments such as pharmaceuticals, electronics, and food production with rapid operation, energy efficiency, a..

Read more

Balancing sustainability and compliance in pharma industry with HVAC solutions

HVAC systems account for more than 50 per cent of total energy consumption in cleanrooms. Kishor Patil of Trane Technologies explores how energy-efficient HVAC systems can help pharmaceutical compan..

Read moreRelated Products

Cast Iron Plug Valve

Unitek Valves engages as a trader, wholesaler and

supplier of cast iron plug valves.

Pf Series Fixed Pump

HTM Hydraulics Pvt Ltd offers a wide range of PF Series

fixed pump.

PF Series Water Bases Fluid Pump

HTM Hydraulics Pvt Ltd offers a wide range of PF series water bases fluid pump.