Schedule a Call Back

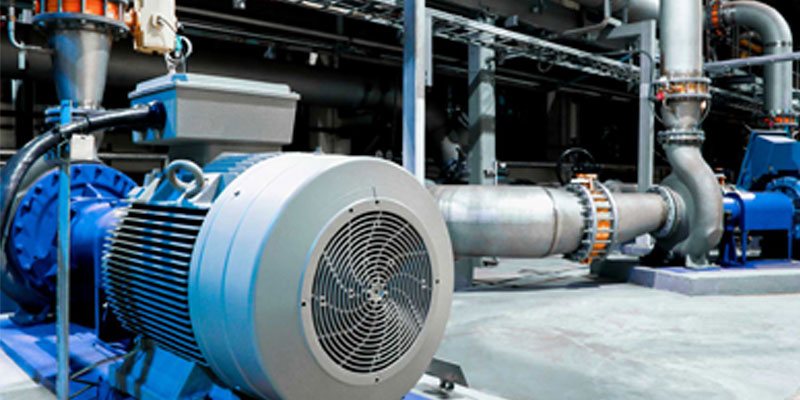

Process industries to drive demand for industrial pumps

Industry News

Industry News- May 28,22

The global industrial pumps market size - valued at $ 61.63 billion in 2021 - is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2022 to 2030, according to a Grand View Research (GVR) study. The rising adoption of these products in various industries, including water and wastewater, chemical, oil and gas, and power generation, is expected to have a positive impact on the market growth.

The lockdown measures implemented by the governments of various countries, in light of the onset of the COVID-19 pandemic in 2020, have adversely affected the growth due to the closure of the manufacturing industries. Furthermore, the pandemic has resulted in delays in raw material distribution, thereby affecting the production capacity across the globe.

Factors such as high electricity demand, industrialization, and investments for renewable power generation in the country are anticipated to augment the demand for industrial pumps in power generation. Increasing investments in exploration and production activities by oil & gas companies in the US are anticipated to boost the demand in the oil & gas industry.

Global oil & gas production is likely to witness significant growth from non-OPEC countries and developing countries. Growing demand for energy, shale gas, tight gas, and coal bed methane (CBM) on account of the maturity of the conventional oil & gas resources is expected to be a major driver triggering the growth.

The regulatory framework implemented in the Middle East and China for enhancing the production output of the domestic refining sector is expected to lead to the increased demand for industrial pumps used in refineries across these geographies. This, in turn, is projected to fuel the growth in the Middle East and China.

Price variations in industrial pump components due to strong demand from end-user industries are expected to have a negative impact on capital investments throughout the projection period. Major companies are likely to increase their efforts in developing low-cost manufacturing processes and modern technology development for the productivity improvement of the pumps over the forecast years, thereby boosting the growth.

Product insights

Centrifugal pumps have led the market and accounted for a revenue share of over 65.0% in 2021. “These products are widely utilised in several applications, including water supply, fire protection systems, sewage disposal, food and beverage industries, and chemical industries, due to their low maintenance,” said GVR study.

The growth of the global centrifugal pumps market is being driven by the rapid construction of residential and commercial infrastructure and the expansion of the manufacturing sector. The growth is attributed to the increased infrastructure investment, which has resulted in fast urbanization. The wastewater treatment sector's demand for these products is expected to drive the industry over the coming years.

The positive displacement pumps are expected to expand at the fastest CAGR of 5.4% over the forecast period. Positive displacement pumps are expected to witness significant growth over the forecast period as reciprocating pumps gain popularity due to their higher efficiency than centrifugal pumps and their application in precision dosing and high-pressure output applications.

The increased investment in specialised reciprocating pumps is due to the current complex refining process, which involves high temperatures, high pressures, and the ability to handle volatile fluids. As a result, the market for positive displacement pumps is likely to grow over the forecast period, thereby driving this industry.

Application insights

The water and wastewater treatment segment led the market and accounted for a revenue share of over 20% in 2021. The increasing demand for water treatment facilities to meet the world's growing water scarcity needs across municipalities and industries is driving the demand for water pumping systems across the globe.

These products are utilised in a variety of applications in the power generation industry, including boiler feed water, cooling water, circulation water, condensate water, flue gas desulfurization services, and auxiliary services. Moreover, steam generation, which is a critical aspect in power plants, requires several products that include boiler feed pumps, booster pumps, condensate pumps, and circulating pumps.

The demand for these products in the chemical industry is likely to expand at a CAGR of 5.4% over the forecast period. The chemical industry is one of the major contributors to industrial economic growth as a source of raw materials for a wide range of sectors. The application of these products in the chemical sector is expected to rise due to the increasing concerns over employee safety and the surrounding environment.

Industrial pumps are required in several applications in the construction industry, which include dewatering, removal of excess water to prevent waterlogging, cement production, dyeing processes, roofing tile production, and dust trapping. Peristaltic pumps are used for chemical dosing and transfer of cement slurry in construction.

Asia leads the growth chart

Manufacturers compete on a variety of aspects including product pricing, performance, design, technology, reputation, and availability. Companies are adopting a variety of strategies to expand their market reach and market share, including new product launches, distribution network expansion, R&D spending, and mergers and acquisitions. Some prominent players in the global industrial pumps market include Grundfos Holding A/S, Xylem, Ingersoll-Rand, Flowserve Corporation, SPX Flow, KSB SE & Co KGaA, Sulzer Ltd, Pentair, Schlumberger Limited, EBARA International Corporation, HERMETIC-Pumpen GmbH, etc.

Asia Pacific led the market and accounted for a revenue share of over 40% in 2021. As the groundwater levels are reducing in the region, water reuse has become increasingly popular in recent years, which has expanded the use of pumps for the building of water and wastewater infrastructure, resulting in higher demand for the product.

The increase in energy demand and the government's continued investment in sustainable energy sources are expected to fuel growth in Europe. Furthermore, strict laws aiming at reducing water pollution are likely to play a vital role in driving the demand for water treatment in the municipal and industrial sectors, which will drive this industry throughout the forecast period.

Despite having abundant water resources, water distribution in Central and South America is inconsistent. Additionally, due to a lack of quality infrastructure in the region, more water is being drained from local basins to meet overall water needs. Furthermore, the robust presence of oil & gas reserves in Brazil, Argentina, Venezuela, and Columbia is expected to have a positive impact on the industry growth.

Oil-based industries in Saudi Arabia include the companies engaged in the production of oil, industrial gas, petrochemicals, and refineries of petroleum, ammonia, and caustic. Thus, the presence of vast oil & gas reserves, coupled with a robust infrastructure for processing oil, is anticipated to propel the growth of the petrochemical industry, thereby boosting the demand for these products.

Courtesy: Grand View Research

Related Stories

Manufacturing, infrastructure growth to drive India’s bearing market

Global bearing demand is accelerating on the back of Asia’s industrial expansion. India is set to record robust gains driven by manufacturing and infrastructure growth.

Read more

Cost Savings Through Optimising Pump Performance

Optimisation of pump operations, a piece of equipment that is widely installed across industries, offers significant opportunity for cost savings. In this article, Sulzer reveals how optimising pump..

Read more

India: A responsible leader in the evolving manufacturing sector

India's growing manufacturing sector, coupled with its commitment to sustainability, presents a unique opportunity for the country to become a global leader in responsible manufacturing, says Marc J..

Read moreRelated Products

Cast Iron Plug Valve

Unitek Valves engages as a trader, wholesaler and

supplier of cast iron plug valves.

Pf Series Fixed Pump

HTM Hydraulics Pvt Ltd offers a wide range of PF Series

fixed pump.

PF Series Water Bases Fluid Pump

HTM Hydraulics Pvt Ltd offers a wide range of PF series water bases fluid pump.