Schedule a Call Back

India needs to tackle Chinese and other steel imports; Ranjan Dhar, AMNS India

Industry News

Industry News- Jul 01,24

Related Stories

PTC build tech for single crystal & directionally solidified castings production

The company has set up this manufacturing capacity at its Lucknow facility.

Read more

Manufacturing activity in India rebounds in June; fastest hiring in 19 years

As a consequence of increases in new order intakes, the rate of job creation was the strongest since March 2005.

Read more

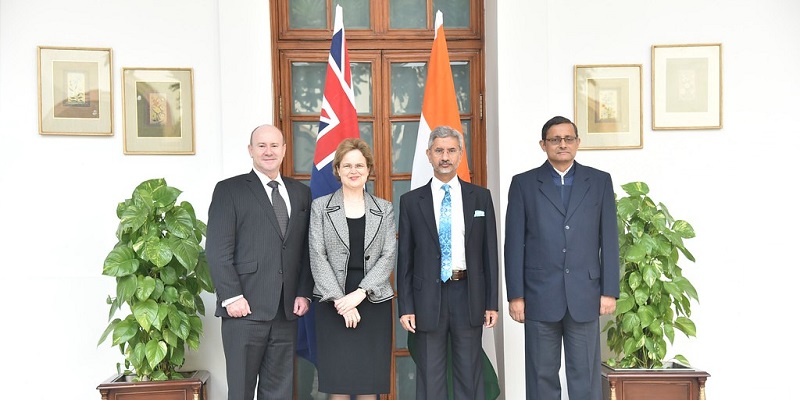

India to receive critical mineral access with Australian FTA; lower emissions

Like Australia, India has signed a trade pact with the four-nation European Free Trade Association (EFTA) and Norway is a key member of that grouping.

Read more