Schedule a Call Back

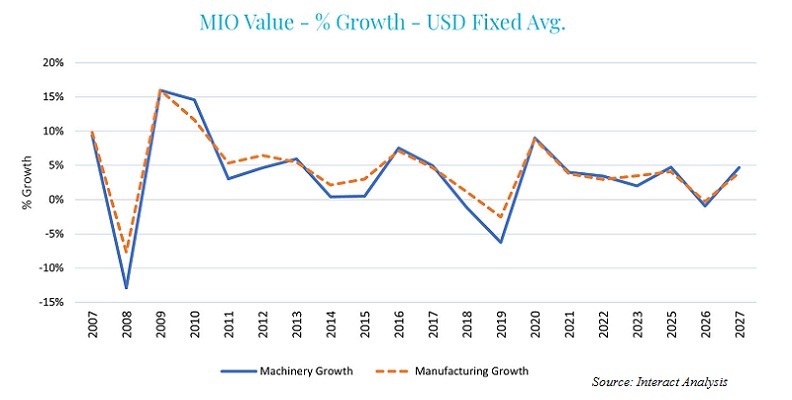

Despite slowdown, global manufacturing industry grew 3.8% in 2022

Industry News

Industry News- Feb 01,23

Related Stories

Tariffs are reshaping automation supply chains: Blake Griffin

In this interview, Blake Griffin, Research Manager, Interact Analysis, highlights how trade wars, geopolitical tensions and rare-earth restrictions are reshaping global automation industry.

Read more

Can AI be the game changer for Indian manufacturers?

While manpower issues and quality are driving adoption of industrial automation, cost and lack of knowledge are causing hindrances. Artificial intelligence (AI) can be the game changer, writes Rakes..

Read more

Automation to Drive Packaging Machinery Market Surge

Rising labour costs, regulatory pressures, and the growing influence of e-commerce are driving the demand for end-of-line and warehousing packaging machineries. This growth is reshaping packaging st..

Read more