Schedule a Call Back

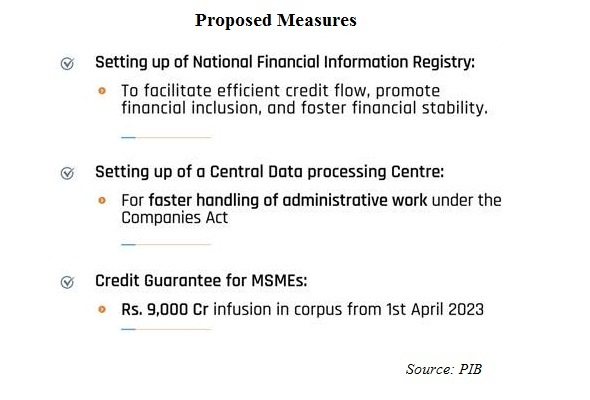

Budget proposes Rs 90 bn for revamped credit guarantee scheme to MSMEs

Industry News

Industry News- Feb 01,23

Related Stories

C-DEP–IIT Delhi Study Flags Tech Logistics Gains for MSMEs, Warns of GST Risks

C-DEP–IIT Delhi study shows tech-enabled intra-city logistics cut MSME costs, boost efficiency, but warns GST 2.0 may raise taxes.

Read more

EV shift, trade pressures threaten India’s auto components: Tushar Bhaskar

India’s auto component industry faces mounting risks as EV-led technology shifts, trade pressures, and critical material dependence threaten its global competitiveness.

Read more

Synopsys and 3D Engineering Open Design Center at MECF in Pune

The facility signifies a significant step in accelerating access to advanced simulation technologies for MSMEs.

Read more