Schedule a Call Back

Demand will suffer if module prices rise by 20%

Interviews

Interviews- Oct 01,17

Related Stories

India adds 205 MW solar capacity in Q2: Report

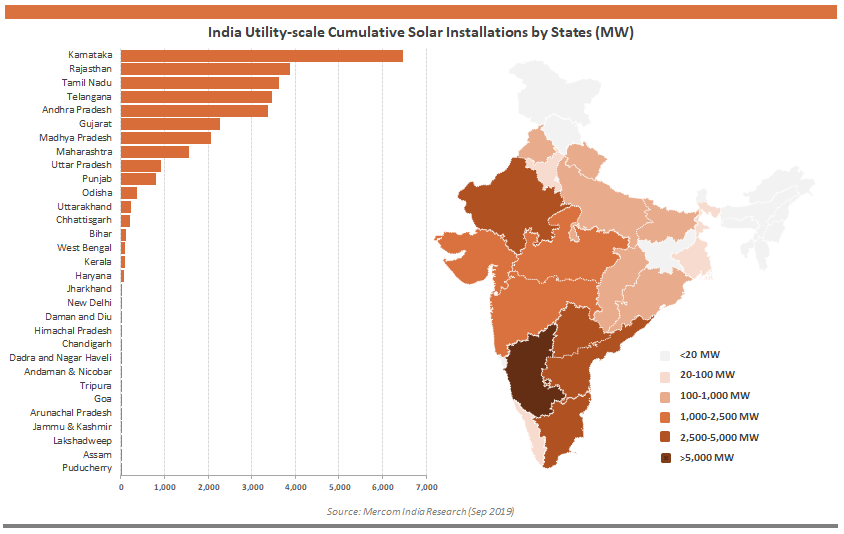

Solar installations in the first half of 2020 were 1.3 gigawatts (GW), a 59 per cent decrease compared to 3.2 GW of capacity added in 1H of 2019.

Read moreIndian solar installations up by 44 per cent in Q3 2019: Mercom

According to the report, India’s cumulative solar installations stood at 33.8 gw by the end of Q3 2019.

Read more

Indian solar installations up by 44 per cent in Q3 2019: Mercom

Tamil Nadu was the top state for large-scale solar installations in Q3 2019

Read moreRelated Products

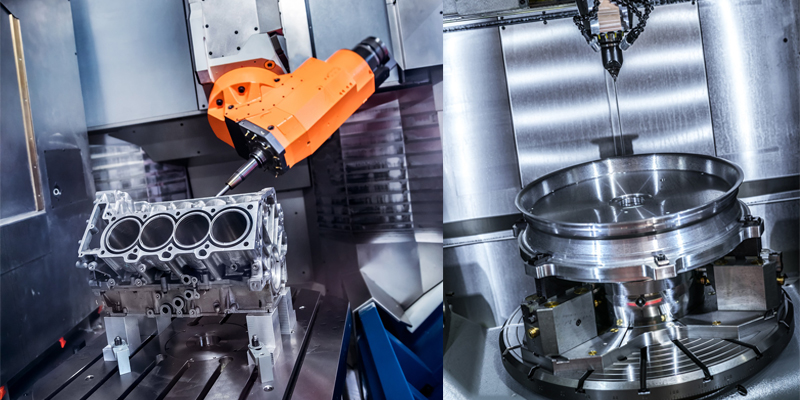

Robot Plus

Schunk Intec India Pvt Ltd offers a wide range of robot plus.

Pm Powder Metallurgy High Speed Steel – High Performance Taps

SS Trading offers PM power metallurgy high speed steel high performance taps - Powder metallurgy high speed steel grade is premium steel engineered for hardness, wear resistance , tool life, heat r Read more

SWR ’Slipping’ Wrenches

Reliable

Trade Links offers a wide range of SWR ’slipping’ wrenches.