Schedule a Call Back

India needs strong machine tools industry to become a global manufacturing hub

Articles

Articles- Dec 30,24

Table 1: Merchandise trade during April-November 2024

| Apri-Nov 2023 (in $ billion) | Apri-Nov 2024 (in $ billion) | Growth (%) |

Exports | 278.26 | 284.31 | 2.17% |

Imports | 449.24 | 486.73 | 8.34% |

Source: PIB.gov.in

India's aspiration to establish itself as a global manufacturing hub under the Make in India initiative depends heavily on the capabilities of its domestic machine tool sector, which is considered to be the “mother industry” as it plays a pivotal role in the production of machinery, components, and equipment for a wide range of industries.

Market prospects

The global machine tools market, which experienced moderate growth during the period from 2019 to 2023, is driven primarily by industrial expansion in emerging economies like China and India and increasing automation in manufacturing. According to Fairfield Market Research, global sales of machine tools are expected to reach $111.8 billion by 2031 from $ 86.7 billion in 2024 - registering CAGR of 3.7 per cent.

Sharing her views on the global market, Melissa Albeck, Member of the Executive Board of the CERATIZIT Group, says, "2024 has been a challenging year for the cutting tools industry, especially in Europe. The economic situation remains tough, with recent crises impacting market strength, particularly in the automotive sector. The transition to electric vehicles has slowed, leading to reduced machining volumes. However, there are bright spots. The aviation sector shows optimistic potential, and the electronics industry appears promising."

Countries in Asia Pacific, such as China and India, are showing strong demand for machine tools because of the government support for industrialisation and infrastructure development. According to Gardner’s World Machine Tools Output Survey, India’s machine tool industry holds the 9th position globally in production and ranks 6th in consumption. As an essential segment of the capital goods industry, which accounts for 12 per cent of the manufacturing sector, it encompasses a multidisciplinary domain with a wide range of end-use applications.

Rajendra S Rajamane, President, Indian Machine Tool Manufacturers' Association (IMTMA), elaborates, "Financial year 2023-24 was good for the Indian machine tool industry, with an estimated increase of around 10 per cent year-on-year in production, reaching around $1.6 billion. It was a good period for exports, with a reported 13 per cent growth, amounting to about $200 million while consumption was estimated to have increased by around 11 per cent to reach $3.3 billion."

Over the past five years, while consumption levels have remained stable, India’s global production rank has risen from 11th to 9th, showcasing the market's increasing competitiveness and a consistent growth in export figures.

Thriving Indian market

The Government of India (GoI) has set a goal of a $5 trillion Indian economy by FY2026. To achieve this milestone, the manufacturing sector is expected to contribute $1 trillion, underscoring the critical role of the machine tool industry in this transformation. The Indian machine tool industry must focus on producing high-precision machines to support the manufacturing sector in increasing its GDP contribution.

Gururaj Patil, Managing Director, EMAG India Pvt Ltd, says, "The Indian machine tool industry is currently experiencing significant disruption. Gone are the days when machine tools were designed to address a single machining application. Today, the focus is on combining as many operations as possible in a single machine to reduce setup times and costs. While the demand for integrated operations is growing rapidly, there is also a strong desire to keep machines compact, preferably with inbuilt automation."

India is experiencing a transformative evolution in manufacturing, progressing from solving local challenges to delivering globally competitive solutions. This transformation is driven by precision engineering, which leverages advanced technologies to foster self-reliance in key sectors. At the core of this shift, precision engineering enables the production of world-class products for industries such as aerospace, defense, and automotive. Numerous Indian companies are crafting high-precision components that not only meet but frequently surpass international standards.

In FY23, the Indian metal cutting machine tool segment reported a consumption of ?192.32 billion, with local production reaching ?101.95 billion. Lathes accounted for the largest share of metal-cutting machine tool consumption at ?47.23 billion, representing 25 per cent of the total. Similarly, the metal forming machine tool segment recorded a consumption of ?53.04 billion, with local production amounting to ?21.33 billion. Presses dominated metal-forming machine tool consumption, contributing ?24.94 billion, which is 47 per cent of the total in FY23.

Table 2: Indian machine tools market in FY23

| Metal cutting | Metal forming |

Consumption | ? 192.32 bn | ? 53.04 bn |

Local production | ? 101.95 bn | ? 21.33 bn |

Rajendra Rajamane states, "The machine tool industry needs to create demand initially in the domestic market by building cost-effective standard products, and besides this, it needs to create a good supply chain. Once it aligns itself with global standards compliance, such as CE marking, the industry will gain the necessary confidence to venture into untapped markets and explore new growth opportunities. India presently exports around 10 per cent of what it produces to global markets, and we have a long way to meet the size of markets in Asia, Europe, and America.”

Global machine tool manufacturers are increasingly focusing on India, leveraging its rise as a key manufacturing hub in Asia. Tokyo-based Tsugami, known for producing automatic lathes for the automotive and electronics sectors, opened its first casting plant in India in April 2024. Furthermore, a processing and assembly plant is scheduled to begin operations by April 2025, with a total investment of Yen 3.6 billion ($23 million) for both facilities. Similarly, Brother Industries Ltd completed construction of a new machine tool factory, its third machine tool manufacturing facility after those in Japan and China, near Bengaluru in September 2024.

Sanjay Sangam, Head - Sales and Marketing India, Renishaw Metrology Systems Ltd, says, "Like every global business, the machine tool industry is expanding, new investments are flowing in and both the domestic and export markets are seeing significant demand. The rapid industrialisation and modernisation of various sectors have created a need for advanced manufacturing technologies and precision engineering solutions. Additionally, the Indian government's initiatives to boost local manufacturing and infrastructure development have further fueled this demand. India presents a highly promising market for us, driven by its swift industrial growth, an increasing emphasis on manufacturing quality, and the integration of advanced technologies in vital sectors.”

Andreas Fritz, President of CERATIZIT Asia Pacific, adds, “The machine tools industry in India is experiencing robust growth, driven by an expanding market and the relocation of businesses seeking reliable and economical partners. This growth is further supported by a strong GDP forecast and continuous investments in automation, robotics, and digitalisation."

Automotive: Demand overdrive

India, now the most populous country in the world, is poised for continued population and economic growth. This progression is expected to drive increased demand for machine tools, particularly in the automotive sector. "India now has the third-largest automotive market globally, with the Faster Adoption and Manufacturing of Electric Vehicles (FAME) schemes encouraging buyers to opt for electric and hybrid vehicles. FAME II’s offer of upfront incentives for customers purchasing electric vehicles (EVs) saw over 1.36 million vehicles sold by December 2023. Consequently, this drives demand in the automotive industry for modern cutting tools that work effectively with lightweight, durable materials such as composites and aluminium,” observes Sunil Joshi.

The automotive sector and the machine tool industry share a symbiotic relationship, where growth in one fuels demand in the other. For years, the expansion of the automotive sector has been a key driver for the machine tool industry. Sanjay Sangam opines, "India’s transition towards electric vehicles, the push for sustainability, and the demand for improved fuel efficiency are key growth drivers. The use of electronics, sensors and displays is rising in both EVs and internal combustion engine (ICE) markets. Renishaw products are used throughout EV manufacturing and offer our customers significant benefits in productivity and quality."

Hybrids and EVs are having a tremendous impact on the Indian machine tools industry. Gururaj Patil states, "In India, the growth of hybrid vehicles and EVs will continue in the near future. While the pure EV segment may not grow as quickly as hybrids, the infrastructure boost for charging stations in non-metro cities will accelerate the adoption of both two-wheelers and four-wheelers. We developed optimised solutions for the EV sector nearly two decades ago and now offer excellent solutions for chassis, transmission, and safety-related components within the EV ecosystem."

EV transmissions require fine finishing to achieve high-performance finishes. Sameer Kelkar, CEO and R&D Head, Grind Master Machines Pvt Ltd, says, "There is a paradigm shift in the automotive powertrain sector. Conventional internal combustion engines (ICEs) are being replaced with hybrids and battery electric vehicles (BEVs). Rotating shafts are common to all these technologies, and the demand for precision finishing is even greater for hybrids and EVs due to their faster rotational speeds.”

The machine tool industry serves as a cornerstone of India's engineering and industrial sector. Its applications span a wide range of industries, including die molding, component manufacturing, aerospace, shipbuilding, electrical and electronics, healthcare, and consumer durables. Rajendra Rajamane states, "Auto industry has been the largest consumer of machine tools in India for several years. While the machine tool industry will continue to engage closely with the auto sector, it is also broadening its scope to do business with many of the rainbow sectors. In recent years, particularly, there has been an increase in demand from strategic sectors, which has resulted in the machine tool industry diversifying its portfolio. As a result, the machine tool industry works more closely with sectors like aerospace, defence, railways, electronics, medical equipment manufacturing, semiconductors, toy manufacturing units, and many others."

Defence and electronics on the rise

Indian companies are leveraging advanced manufacturing technologies to develop state-of-the-art solutions, including armoured vehicles, aviation systems, and precision weaponry, elevating the country’s global standing in defense manufacturing. A robust industrial base and strong government support are enabling private players to innovate in advanced components and systems designed for strategic needs. This thriving ecosystem is propelling India toward becoming a global leader in defense and aerospace manufacturing.

India's vast pool of engineering talent, combined with advancements in materials science, precision tools, and manufacturing processes, is playing a crucial role in tackling global capacity constraints. For instance, the global aerospace sector faces unprecedented order backlogs and production bottlenecks—a challenge where India's precision engineering expertise can make a meaningful difference. Airbus's establishment of a Maintenance, Repair, and Overhaul (MRO) center in India underscores the country's capability to meet rigorous quality standards and efficiently support global supply chains. Sunil Joshi opines, "With India predicted to be the world’s largest aviation market by 2047, we are increasingly seeing manufacturers looking for tooling options for precision aerospace components."

Customers from end-user industries are looking for greater fuel efficiency, lighter components and ways to reduce costs. Sanjay Sangam adds, "With initiatives like Make in India and Aatmanirbhar Bharat, there is a growing emphasis on domestic manufacturing in defence and aerospace. The fall in demand during the COVID-19 pandemic has eased, and there are significant order backlogs and strong global demand for fuel-efficient, narrow-body, single-aisle aircraft. The manufacture and assembly of engines, wings, control systems and landing gear rely on process control and post-process inspection using Renishaw products."

India is transitioning from a global dependency to a focus on self-reliance, making significant strides in bolstering its defense manufacturing capabilities. With a defense budget of ? 5.94 trillion (approximately $72 billion) for 2023-24, the nation is fostering indigenous innovation to reduce import dependency. Indigenisation levels have surpassed 65 per cent in critical areas, underscoring India’s dedication to establishing a strong and self-sufficient defense ecosystem.

Rising demand from key sectors such as automotive, auto components, general engineering, and consumer durables elevated the domestic production market share to 44 per cent in FY23. Moreover, the growing needs of emerging industries like mobile manufacturing, specialised electronic components, medical devices, and drones significantly bolstered the domestic market for large-scale machine tools during FY23.

Sanjay Sangam says, “With consumers expecting increasingly lightweight and compact products with more features, greater reliability, and longer battery life, regular updates and upgrades are required faster than ever before. Our consumer electronics customers therefore demand flexible manufacturing systems that can adapt to shorter product life cycles, yet still deliver high-quality, high-volume components. Consumer electronics is one of our largest sectors and includes products such as mobile phones and flat panel displays. The introduction of new generations of electronic devices will be key drivers for future growth.”

Road blocks on the path

While the domestic manufacturing sector has been booming, manufacturers in India are still relying on imports for nearly 50 per cent of their machine tool needs. General-purpose machines are often sourced from China, where product quality is steadily improving, while specialised machines are primarily imported from countries like Germany and Japan. “To compete successfully, the Indian machine tools industry must focus on innovation, quality improvement, and support from both the Indian manufacturing sector and the government. As the backbone of manufacturing, the Indian machine tools industry—built by passionate pioneers—needs nurturing to become a global leader,” opines Sameer Kelkar.

Rajendra Rajamane adds, “Indian machine tool industry is good when it comes to design and manufacturing competence for a wide range of products. However, the product range and home-grown technologies have a substantial gap with ones manufactured overseas. User industries need the highest quality products at competitive prices; thus, making it imperative to develop them indigenously."

The Indian machine tool industry must also focus on manufacturing high-precision machines to address the growing demand for producing advanced components from metals such as titanium and others. Andreas Fritz says, "There are several key hurdles on the growth path. Despite the advancements, many people still prefer high-tech machines from Europe and Japan. Additionally, the development of production infrastructure towards precision is progressing slowly, and a significant portion of components in machine tools are still imported. More specifically for the cutting tools sector, the industry faces challenges such as the lack of availability of tungsten and cobalt within India, the absence of recycling technology, and a shortage of the right kind of qualified workforce."

According to Sunil Joshi, despite the growth of the nation’s manufacturing sector in recent years, India is facing a shortfall of 150 million skilled staff in 2024. “The lack of skilled professionals is particularly apparent in technical roles like those found in the manufacturing sector, with a study revealing that only 44 per cent of Indian graduates are employable for technical roles. Addressing this skills shortage is crucial for the continued growth of India’s manufacturing industry,” he adds.

Emerging sectors like aerospace, electronics, and renewable energy present significant opportunities. However, specialised technologies for these industries demand substantial investment in R&D and a conducive environment from the user industry. In India, such supportive conditions are often insufficient, leading to a continued dependence on imported technologies in these sectors.

Rajendra Rajamane explains, “Strategic sectors, such as aerospace, defence, nuclear industries, etc, have complicated profile components that need simultaneous interpolation of 4, 5, or more axes. There are challenges in importing certain machines for key strategic sectors and to overcome that, Indian machine tool industry needs to invest substantially in R&D. This is a long-term plan, and we would reap the benefits of substituting imports over a period of time.”

Adding a “Smart” touch

Building on India's progress in precision engineering, the next milestone is leveraging the transformative potential of automation to revolutionise productivity, decision-making, and innovation across various industries. “We are seeing a wider adoption of Industry 4.0, including the integration of artificial intelligence (AI), internet of things (IoT) for predictive maintenance and process optimisation, besides smart factories with interconnected devices and real-time monitoring. Automation is gaining wider traction with increased use of automated solutions and robotics,” observes Rajamane.

The growing adoption of smart manufacturing practices is significantly influencing the machine tools industry. A report by Global Market Estimates predicts that India’s smart manufacturing sector will experience a compound annual growth rate (CAGR) of 8.1 per cent from 2024 to 2029. "As part of this shift, the machine tools sector must embrace technologies such as Internet of Things (IoT) and cloud-based systems, which will allow them to improve tool performance and reduce downtime. Manufacturers also need to ensure that their employees are prepared for smart manufacturing, with recent IBM research predicting that around two-fifths of the workforce will need to reskill due to the implementation of automation technologies,” observes Sunil Joshi.

The machine tools industry is experiencing transformative changes driven by several key technologies. Sanjay Sangam opines, “We are seeing a general trend towards more automation and ‘smart’ factories across all our sectors. Digital technologies are transforming the industrial sector, enabling manufacturers like us to embrace data-driven manufacturing. The shift toward automated manufacturing processes is revolutionising the industry. Technologies like machine tool probing systems, in-process gauging, and tool monitoring are critical for achieving precision, efficiency, and real-time process control.”

Leveraging ML and AI has become crucial for every machine tool company today. Sunil Joshi opines, “In the metalworking sector specifically, AI can optimise tool paths, improve machining precision and enables predictive maintenance by analysing real-time data from equipment. Sandvik Coromant uses distributed AI to monitor cutting conditions, adapt to material variations and reduce tool wear, ensuring consistent performance, reduced downtime and efficient resource utilisation.”

New technologies like 3D printing (additive manufacturing) are also transforming manufacturing by driving automation, precision and innovation. “Adoption of 3D printing for prototyping, low-volume production, and hybrid machines combining additive and tractive processes is seen in manufacturing space in a big way. Digital twin technologies with virtual simulations to optimise machine performance before production as well as high-precision and speed machine tools are being used,” says Rajendra Rajamane.

Path to sustainability

Sustainable practices, green manufacturing, the use of energy-efficient machines, and waste-reduction techniques are gaining popularity across industrial segments. "Sustainability is a significant transformation along the entire value chain. The supply of raw materials must become more circular in the future. Not only because it is better for the environment, but above all because the tungsten and cobalt reserves are finite, and the supply of fresh ore is far too dependent on China and conflict regions. This dependency represents a major risk,” says Melissa Albeck.

The machine tools industry is also taking steps to effectively promote circular economy. She adds, "Large, listed international customers are the ones who show the greatest interest in the product carbon footprint (PCF) of our products, as products with a lower PCF reduce their corporate carbon footprint in Scope 3. However, greater sustainability also means that we need to realign the focus in R&D, for example to raise the quality of recovered raw materials to a high level across the board and increase the recyclability of products."

Sustainability influences processing methods, focusing on optimising energy consumption during product manufacturing and minimising the ecological footprint of finished products, whether machines or components. "From a sustainability perspective, an increased focus on lightweighting is essential for industries like automotive and aerospace. It not only reduces the use of finite resources, but also limits the amount of energy consumed by vehicles. Lightweighting drives significant changes in the cutting tools sector as manufacturers are increasingly tasked with machining lightweight materials such as aluminium and advanced composites, as well as producing weight-efficient components from traditional metals like steel and cast iron. This shift demands cutting tools that enable higher precision, reduce material waste and improve energy efficiency,” says Sunil Joshi.

Gaining cutting edge leadership

Geopolitical tensions and the adoption of the China+1 strategy are driving global companies to diversify supply chains, presenting a big opportunity for India to position itself as a reliable alternative to traditional manufacturing hubs. In addition, the stability of governance, marked by the current government’s third consecutive term, ensures a predictable and supportive business environment that fosters long-term investment opportunities. India needs to take steps to capitalise on these favourable macroeconomic and geopolitical trends bolstering its position as a global leader in the manufacturing arena.

Melissa Albeck opines, "The transition to e-mobility will be one of the major trends. In addition, the processing of difficult-to-machine materials and composite materials will continue to gain in importance and drive R&D and product innovation, as it has in recent years. Efficiency has always been important for cost reasons. However, in connection with the growing importance of sustainability considerations in the manufacturing industry, it takes on a new dimension. For example, a process that is faster also requires less electricity and causes lower CO2 emissions. Users therefore benefit from more efficient processes in two ways.”

The India machine tools market, which generated a revenue of $ 2,208.2 million in 2022, is expected to reach $ 3,873.2 million by 2030, growing at a CAGR of 7.3% from 2023 to 2030. This growth in the coming years presents huge growth opportunities to companies. Gururaj Patil explains, "We see enormous growth potential in India, driven by the need for precise part production at large volumes, powered by automation. We expect a significant shift in manufacturing to India due to the competitive manufacturing environment."

As 2025 begins, India must harness its potential to redefine global industries by focusing on manufacturing high-quality products and components. Machine tools industry can power this transformation by adopting modern technologies, nurturing engineering talent, and sharpening its expertise to produce innovative for globally markets.

Related Stories

India serves as a strategic pillar for Silmax’s Asian expansion: Dr Fumagalli

In this interview with Rakesh Rao, Dr Dario Maria Fumagalli, President & CEO, Silmax, elaborates on the growth potential of India’s machine tools industry and the company’s long-term commitment ..

Read more

Can AI be the game changer for Indian manufacturers?

While manpower issues and quality are driving adoption of industrial automation, cost and lack of knowledge are causing hindrances. Artificial intelligence (AI) can be the game changer, writes Rakes..

Read more

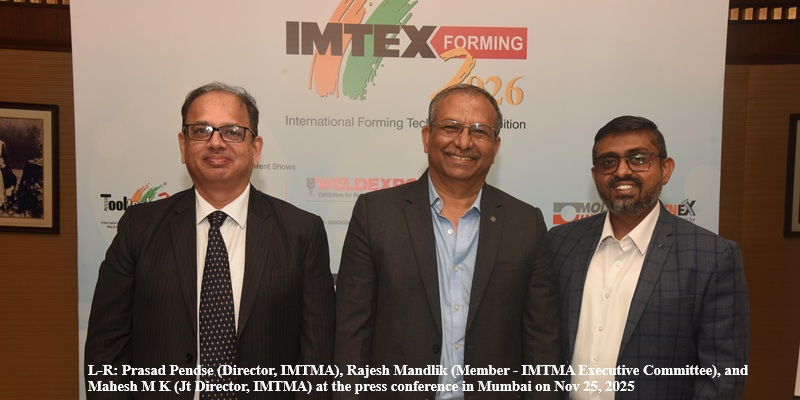

IMTEX Forming 2026 to bring together global metal forming leaders in Bengaluru

At the Asia's largest metal forming exhibition, 600+ global exhibitors from 20 countries will showcase latest technologies in metal forming, digital manufacturing, welding, and moulding among others..

Read moreRelated Products

Precision Cutting Tools1

S S Trading Corporation offers a wide range of precision

cutting tools.

Slotting Head Unit for All Cnc Turn Mill Centers

Sphoorti Machine Tools Pvt Ltd offers a wide range of

slotting head unit for all CNC turn mill centers.

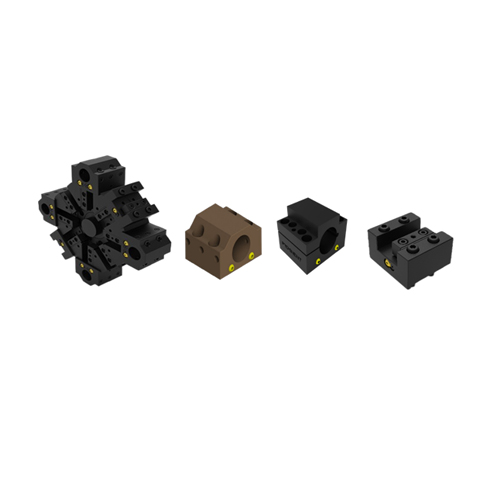

Slotted Tool Disc and Tool Holders

Prominent Machine Tools offers a wide range of slotted tool disc and tool holders.