Schedule a Call Back

Honouring excellence in SME sector

Articles

Articles- Dec 01,18

Related Stories

Will revised MSME classification solve their funding puzzle?

Only 14 per cent of credit needs of Micro, Small and Medium Enterprises (MSMEs) - the backbone of India's economy - are met through formal channels. The revised MSME classification may mark a pivota..

Read more

Private capex revival remains unlikely in 2025, says RBI survey

The findings differ from the RBI’s Financial Stability Report (FSR), which indicated that India’s economic growth is poised to recover in 2025, driven by strong consumer and business confidence...

Read more

MSMEs' contribution to the GDP

As on 16.07.2024, the total employment reported by the MSMEs on the Udyam Registration Portal (since 01.07.2020 to 16.07.2024) is 203.9 million(including informal micro enterprises registered on Udy..

Read moreRelated Products

Turning Tools

Duracarb Cutting Tools offers a wide range of Turning

Tools.

Carbide Burrs

SRT Industrial Tools & Equipments offers a wide range of carbide burrs.

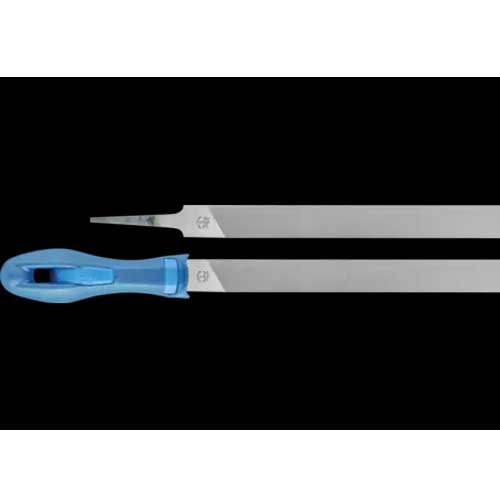

Mill Saw Files Hand

PFERD offers a wide range of mill saw files hand.