Schedule a Call Back

Vikram Handa: Epsilon to scale-up graphite anode material capacity to 37,000 TPA

Interviews

Interviews- Apr 30,21

Related Stories

Semiconductors are at the heart of every electronics device today: Satya Gupta

Electronics manufacturing has taken off in a big way in India over the last 10-15 years.

Read more

Sustainability in automation with Schmalz

Compact ejectors play a critical role in a variety of industrial applications. They are particularly suited for handling airtight and slightly porous workpieces, ensuring high precision and efficien..

Read more

EV batteries shaping the future: Ankit Sharma

The EV revolution is being fueled by rapid advancements in battery technology, from lithium-ion innovations to emerging chemistries like solid-state and LMFP.

Read moreRelated Products

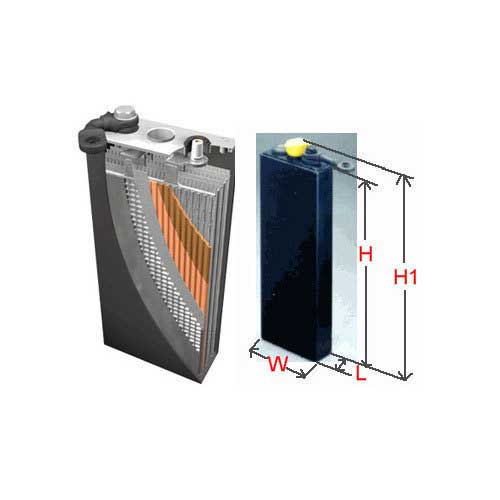

Forklift Battery

Aatous International is a manufacturer and solution provider of a wide range of forklift battery.

Wrist Type High Voltage Alarm

‘KUSAM-MECO’ has introduced a new wrist Type High Voltage Alarm Detector - Model KM-HVW-289 having a wide sensing range from 1kV-220 kV AC.

Servotech Power Systems files 2 patents for energy management technologies

Servotech Power Systems, a leading manufacturer of EV chargers and solar solutions, has announced that it has filed two patents for innovative energy management technologies in order to facilitate gri Read more