Schedule a Call Back

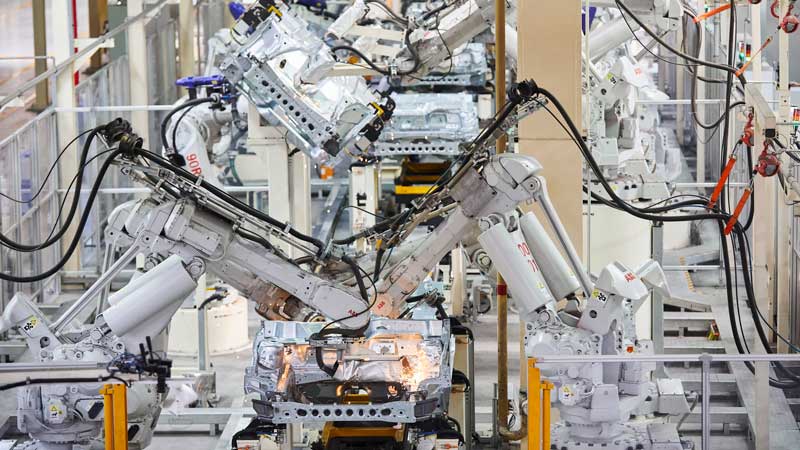

Variations in the industrial robot market

Industry News

Industry News- Dec 13,24

Related Stories

Variations in the industrial robot market

The Indian manufacturing industry continues to experience strong growth in 2024, spurred on by government investments in infrastructure. Industrial robots are rapidly gaining traction in India, says..

Read more

Hannover Messe 2025: 5,000 firms to showcase production solutions of the future

The focus of Hannover Messe 2025 is on the interaction of robotics, artificial intelligence, drive technologies, sovereign data spaces (Manufacturing X), renewable energies, hydrogen, and a host of ..

Read more

Quest to increase efficiency in manufacturing driving robots demand in India

With 59 per cent increase in robot installation in 2023, India has emerged as one of the strongest growing markets. Many believes robots will be central to achieving India’s ambition of becoming a..

Read moreRelated Products

Fire Alarm

Safe Zone is prominent traders and suppliers of the industry, offering a wide range of wireless fire alarm.

Read more

Sorting Automation Systems

Renovus Vision Automation offers sorting automation systems.

Read more

Manual Bagging System

Alligator

Automations provides a wide range of manual bagging systems.