Schedule a Call Back

Reconciliations under the GST

Articles

Articles- Jul 25,24

Related Stories

Skilled workforce: Driving the future of EV manufacturing

An analysis reveals that out of over 30 EV-related job categories, only a third require skills similar to those in the ICE sector.

Read more

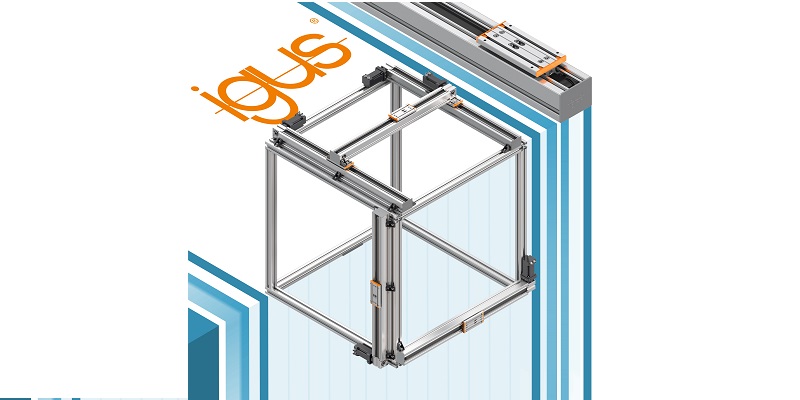

igus expands drive technology range with new toothed belt axes

The drylin ZLX series is suitable for all handling tasks up to a stroke length of 3,500mm and is available ready for connection.

Read more

BPE celebrates 24 years with ‘Vision 25’ awards night

BPE sold 10 MW UPS to a leading solo data centre and 19 units of 500KVA to a leading MNC mobile manufacturing facility in Chennai.

Read more