Schedule a Call Back

Maya Xiao: Cobot market is expected to exceed $ 2 billion by 2026

Interviews

Interviews- Nov 25,22

Related Stories

Honeywell Launches Hybrid Heating to Cut Industrial Energy Costs and Emissions

Honeywell’s Hybrid Heating Solution enables manufacturers to switch between gas and electric heat in real time, helping optimise energy costs, cut emissions and support the energy transition.

Read more

Sagar Defence Invests in EndureAir to Advance Indigenous Aerial Robotics

Sagar Defence Engineering has announced a strategic investment in EndureAir Systems to strengthen indigenous unmanned and autonomous aerial robotics capabilities for India’s defence ecosystem.

Read more

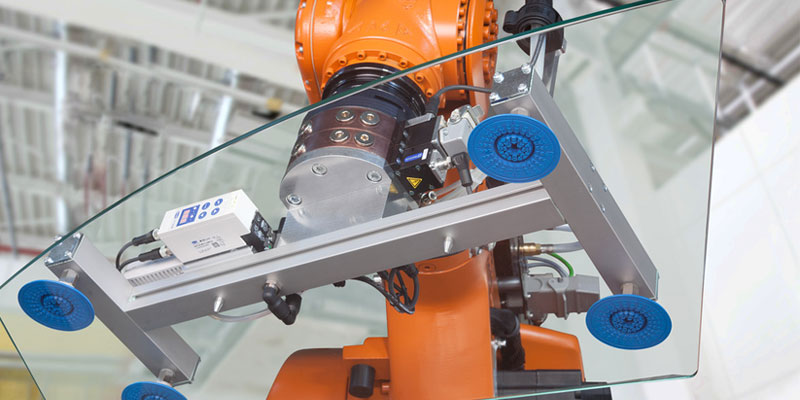

Air-Saving Vacuum Ejectors Cut Energy Use by Up to 90% in Automotive Plants

Air-saving vacuum ejectors are helping Indian automotive manufacturers reduce energy costs, cut carbon emissions and achieve rapid ROI while ensuring reliable, zero-defect production, shares Rajesh ..

Read moreRelated Products

Fanless Industrial Pc for Smart Manufacturing

CONTEC Launches BX-M4600 Series - Fanless Industrial PC for Smart Manufacturing.