Schedule a Call Back

Lead acid batteries to remain relevant in Li-ion era

Articles

Articles- Aug 27,19

Related Stories

“Emphasis should be to make India an integrated manufacturing hubâ€Â

The renewable equipment sector is experiencing a sluggish demand as the pace of adoption of renewable projects in solar and wind is very slow. Sanket D More, Founding Partner, Emerging Power Systems..

Read more

“With Lithium-ion batteries, other accessories will be our focusâ€Â

With much happening under the Government’s vision for EVs, battery companies are gearing up for launching their new products and services. IPF delves into how Lithium-ion battery in..

Read more

Lead acid batteries to remain relevant in Li-ion era

With India set to surpass Japan as world’s No. 3 auto market by 2021 and India sales data has seen double-digit growth in 27 states in India and is fourth largest vehicle market beh..

Read moreRelated Products

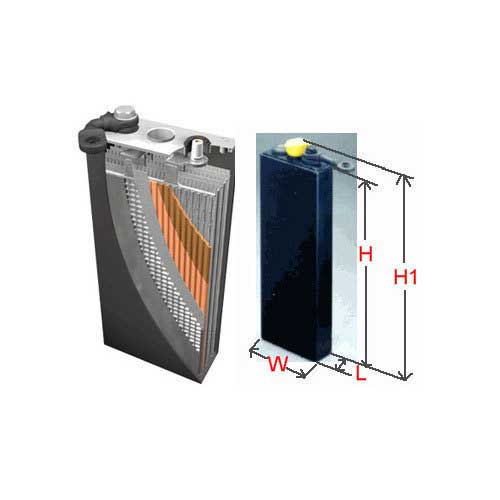

Forklift Battery

Aatous International is a manufacturer and solution provider of a wide range of forklift battery.

Kusam Meco -Wrist Type High Voltage Alarm

‘KUSAM-MECO’ has introduced a new wrist Type High Voltage Alarm Detector - Model KM-HVW-289 having a wide sensing range from 1kV-220 kV AC.

Servotech Power Systems files 2 patents for energy management technologies

Servotech Power Systems, a leading manufacturer of EV chargers and solar solutions, has announced that it has filed two patents for innovative energy management technologies in order to facilitate gri Read more