Schedule a Call Back

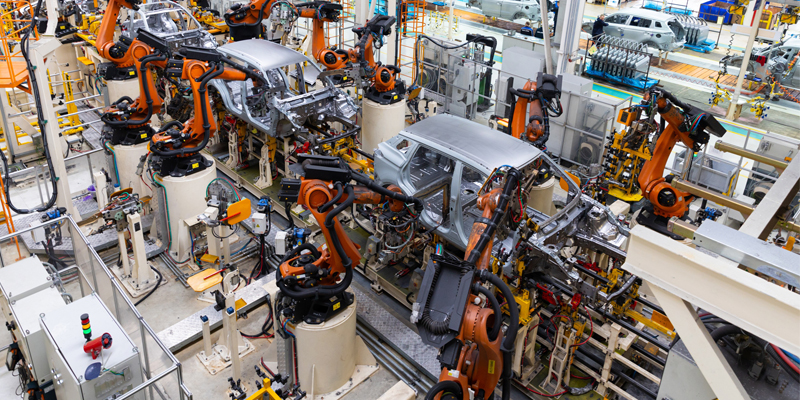

Industrialisation & automation fostering use of industrial robots

Technical Articles

Technical Articles- Dec 01,17

Surge in labour charges worldwide, which in turn has enforced manufacturers to replace human labour with machines, is one of the major demand drivers for industrial robots, says an Allied Market Research report.

The global industrial robotics market, valued at $ 37.875 billion in 2016, is projected to reach $70.715 billion by 2023, growing at a CAGR of 9.4% from 2017 to 2023, according to a report of Allied Market Research.

The articulated robots segment – which accounted for the maximum share in the global industrial robotics market - accounted for $18.35 billion in 2016, owing to increased usage of these robots in the emerging industries such as packaging and healthcare sectors. However, cylindrical robots and other types of robots, such as customised and refurbished robots, are expected to grow at a significant pace in the coming years, owing to their increased demand in the industrial sectors of the Asia-Pacific region. The cylindrical and others segments are estimated to grow at CAGRs of 11% and 11.6%, respectively, during 2017-2023.

The industrial robotics market is segmented based on function into soldering & welding, materials handling, assembling & disassembling, painting & dispensing, milling, cutting, & processing function, and others. In the functions segment, materials handling sub-segment contributed the highest revenue in the global industrial robotics market. The Asia-Pacific region generated the highest revenue in the global industrial robotics market in 2016.

Demand drivers

Global industrial robotics market is driven by factors such as surge in labor charges worldwide, which in turn has enforced manufacturers to replace human labor with machines. Asia and Europe are the key growth regions of the world, with leading players, namely ABB, Fanuc, KUKA, Kawasaki, and the Yaskawa Electric Corporation being based out in the region.

The global industrial production output has plummeted in the recent years, but, is expected to witness significant growth during the forecast period of 2017-2023. The demand for industrial robotics dipped in conventional industries such as automobiles and heavy engineering. However, increased need for automation in non-conventional areas, such as micro-electronics, has increased the usage of industrial robotics. Hence, an auxiliary channel utilising industrial robotics has surfaced in the recent years. The heavy engineering sector drives the demand for industrial robotics.

The global industrial robotics market is impacted by several factors such as usage of industrial robotics in the manufacturing industry, increased demand for automation activities in the industry, reduction in custom duties, and evolving robotics & artificial intelligence (AI) industry. Furthermore, high cost of industrial robotics solutions is a major hindrance for the industrial robotics market growth.

AI: An emerging force

Going forward, AI is likely to have a major impact on the development of industrial robotics. Since the beginning of the decade, artificial intelligence (AI) has been witnessing intense penetration in the industrial robotics market. AI implementation has enabled enterprises to improve their productivity and reduce operation costs. “Automotive, manufacturing, and healthcare industries utilise AI-implemented industrial robots for automation of production activities. Further, key players are investing continuously and coming up with better services to cater to the demand of end users. For instance, in November 2017, Rockwell Automation invested in The Hive, a technology startup with a focus on AI for industrial automation and robotics. This new investment would offer AI-powered applications for security and smart machines,” says Komal Sharma, Analyst working on Construction & Manufacturing domain, Allied Market Research (AMR).

It is expected, that in coming decade, AI will play a major role in the growth of the industrial robots, due to the ongoing R&D projects and expansion of the research division of leading players. For instance, in January 2017, Yaskawa Electric expanded its production and robot manufacturing plant in Slovenia to strengthen the cooperation with original equipment manufacturers in the markets. Moreover, in November 2016, Nuance Communications, Inc. collaborated with ROOBO, a global platform for distribution of intelligent hardware and software, to deliver conversational AI robots. “This collaboration offered voice and natural language capabilities to create conversational interfaces with robots and devices,” she adds.

India’s standing in global robotics market

At present, the Indian industrial robots market is in its developmental phase. However, the Indian government’s initiative to support growth of this market under Make in India campaign is expected to present opportunities for various vendors operating in the market. For instance, in April 2017, Tata Motors subsidiary, TAL Manufacturing Solutions, launched the country’s first manufactured industrial robot BRABO for small and medium manufacturing units in the country. Moreover, Varroc Engineering, an Aurangabad-based manufacturer of automobile plastics and lights, plans on buying industrial robots to expand production facility & business. As per the data released by the International Federation of Robotics (IFR), 2,100 industrial robots were sold in India in 2014, and this number is expected to double in the next two to three years.

“Most of the current growth of robotics in India has been witnessed in the automotive industry. Several automobile giants have established their production plants in India, providing a significant boost to industrial automation. Moreover, various American and Korean-Japanese companies opt for India to be the hub for manufacturing industrial robots. Team Indus, NavStik Autonomous Systems, GreyOrange, and others are few companies involved in the production of industrial robots in the country,” opines Komal Sharma.

Global trends are being observed in the Indian market, majorly in the automotive and manufacturing industry. She says, “Owing to globalisation and high rate of industrialisation, industrial robotics in India is expected to have an optimistic future. For instance, Tata Group company TAL Manufacturing Solutions operates a manufacturing plant in Pune that can develop 3,000 robots a year.”

Similarly, in 2015, a Gurgaon-based startup GreyOrange introduced robots for automation of warehouse processes. GreyOrange’s about 200 robots are being used by leading ecommerce players in their warehouses. These robots operate for 24 hours a day to lift and stack boxes with just 30 minutes break for recharge.

Global players eyeing Indian market

Global players consider India to possess high growth potential for robotics. It is expected that the sale of industrial robots will double in coming two to three years, due to the growing digitisation and automation. “Further, the government’s goal to improve the manufacturing production and productivity under the ‘Make in India’ initiative is attracting numerous foreign players to invest in the country. Growth in foreign direct investments and investments from venture capitalists has also made India a focal country for robotics and automation. For instance, Terry Gou’s Foxconn invested $5 billion in India to build plants for assembling electronics where industrial robotics would be used,” observes AMR’s Sharma.

Rapid adoption of industrial robotics is expected to be witnessed by the automotive, agriculture, ecommerce, and manufacturing sectors in India.

Auto in driving lane

Industrial robots are used in various industries such as automotive, electrical & electronics, chemical, rubber & plastics, machinery, metals, food & beverages, precision & optics, and others. The food and beverages segment is expected to witness the highest growth rate in the near future, owing to spiraling food and beverages industry across the globe.

According to AMR report, the automotive industry segment dominated the global industrial robotics market in 2016, with a revenue contribution of $16,630 million. However, the growth in the automatic segment is expected to plummet, owing to projected slowdown in the automotive industry during the period of 2017-2023.

Industrial robotics provides assistance in completion of sophisticated tasks that demand superior accuracy and precision during their manufacturing processes. For instance, Degrees of Freedom (DoF) available in the Cartesian or joint-armed robots with the attached robotic tool can yield superior welding, cutting, painting, and fine cutting of various tools and parts. “Further, the surge in demand for automobile and commercial vehicles in emerging markets such as India can be easily met through industrial robotics. Thus, the indefatigable machine is expected to a witness positive growth curve, owing to high requirement from the automotive industry. And, as Asia-Pacific leads the manufacturing of automotive industry, it is expected to witness lucrative growth for the industrial robotics market,” Komal Sharma adds.

The Indian automakers are investing heavily on industrial robots, and it is expected that this market will witness steady growth in the near future. In December, 2015, Volkswagen India accounted for more than 115 robots at its Pune plant, while Hyundai Motor India has implemented 400 robots at its factory in Chennai. Similarly, in March 2017, the Maruti Suzuki India Ltd. employed robots for its manufacturing units, including welding, painting, and press shop, at Gurgaon and Manesar. These robots are deployed for the welding of the new generation of its DZire car. At its Gurgaon facility, the company carries out operations with more than 5,000 robots.

Top impacting factors

The following illustration determines the impact of factors on the industrial robotics market growth:

Rapid industrialisation and automation: Increase in demand for automation and rapid growth in industrialisation foster the use of industrial robots. Increased adoption of these robots in automotive, food & beverages, machinery, and precision & optics industries for automating processes, which leads to increased efficiency, reduced human errors, and enhanced safety of the workforce, has been observed. Some painting and pick & place functions are carried out by robotic arms, which reduce complexity and possibility of errors. Surveillance & security have improved due to implementation of drones. Industrial robots deliver high-quality products and services, increase the capabilities of manual labour in terms of efficiency, provide better customer services, and efficiently manage processes.

High labour cost and lack of skilled workforce: Dearth of skilled workforce and high labor costs drive the adoption of industrial robotics in most of the industries in developed and developing nations. Several organisations have implemented industrial robotics solutions to reduce their labor costs and improve efficiency. Although, the initial cost of procuring a robot is high, once implemented it offers high productivity, efficiency, and profits. Moreover, labour wages are on the rise in the American and European markets, and Asia-Pacific is also expected to witness an upsurge in labor costs during the forecast period. Human limitations to perform a particular task and higher productivity from service robots favor the adoption of robotics.

High initial investment: High investment required for the initial setup and integration of industrial robotic solutions hampers the adoption of robots by small and medium enterprises in diverse sectors. For instance, in the machinery & metal sector, the cost of cutting, welding, and soldering machines is significantly high, making it unaffordable for average companies. Industries facing high labor costs are more likely to deploy industrial robots to reduce their expenses and produce high-quality products. Key players need to focus on offering affordable and cost-effective robots to accelerate the acceptance of robots by niche industries. Emergence of new technologies, coupled with increasing competition in the market, is expected to reduce investment costs of robots and accelerate the growth of the industrial robotics market.

Source: Allied Market Research

Related Stories

Driving Efficiency: Schmalz Gripping Systems for India's Manufacturing Future

As the market demands speed, agility, and reliability, Schmalz gripping systems are enabling the next generation automation of Indian manufacturing sector.

Read more

AI-Powered Welding Robots setting a new standard in Top-Tier Automotive Plants

As manufacturing plants undergo digital transformation and Industry 5.0 expectations, AI-powered welders will become more common, says Emily Newton.

Read more

Global industrial robot shipments down in 2024, recovery likely in 2025

As investment cycles pick up and demand stabilises across key industries, 2025 could mark the beginning of a new growth phase, albeit one characterised by tighter margins and more nuanced competitio..

Read moreRelated Products

Collaborative Scara Robot

Malles Automated & Robotic Systems Private Limited

Robotic Deflashing of Aluminium Casting

Grind Master Robotic Deflashing Machine is an advanced and most reliable machine for Aluminium components. Robotic deflashing is a revolutionary technology developed by Grind Master Machines Pvt Lt Read more

Karmi Bot

Asimov Robotics offers a wide range of Karmi Bot.