Schedule a Call Back

I see huge potential for Universal Robots in India

Interviews

Interviews- Jul 01,18

Related Stories

PFAS-Free iglidur i2000 Enables High-Precision, Wear-Resistant 3D Printing

igus has introduced iglidur i2000, a PFAS-free, self-lubricating 3D printing resin offering high precision, durability and wear resistance for moving components in sensitive applications.

Read more

Aimtron Electronics Enters OEM Engagement with Climate-Tech Firm Aurassure

Aimtron Electronics has partnered with climate-tech company Aurassure to manufacture IoT-enabled environmental monitoring systems supporting real-time, hyperlocal climate and air-quality intelligenc..

Read more

3D Printing Strengthens the Foundations of Smart Manufacturing

The global 3D printing market was estimated at $30.55 billion in 2025 and is projected to reach $168.93 billion by 2033, growing at a compound annual growth rate of 23.9 per cent from 2026 to 2033.

Read moreRelated Products

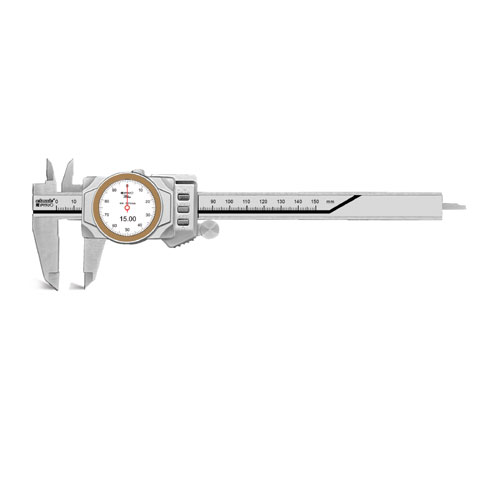

Digimatic Smart Caliper

Veekay Industries offers a wide range of digimatic smart caliper.

Compact Fmc - Motorum 3048tg With Fs2512

Meiban Engineering Technologies Pvt Ltd offers a wide range of Compact FMC - Motorum 3048TG with FS2512.

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.