Schedule a Call Back

TNBA urges to stop auctions and strengthen boiler MSMEs

Industry News

Industry News- Nov 25,20

The Tamil Nadu Boilers Association (TNBA), a body of

manufacturers of boiler and boiler components have appealed to the Union Ministries

of Finance and MSME to direct banks to stop auctioning properties of MSME units

under the SARFAESI Act until the pandemic comes to an end. It also has asked the government to consider Tiruchi manufacturers as a special case and strengthen them.

Expressing concern over banks initiating such action against

micro, small and medium enterprises, Rajappa Rajkumar, Treasurer, TNBA in a

representation to the ministries, observed that the MSMEs were already facing a

severe crisis due to the general recession, policy changes and the lockdown

enforced due to the pandemic.

“Many of them were fighting for their very survival and

workers were losing jobs. MSMEs were awaiting clear guidelines from the

government regarding stressed and NPA units. But at this critical junction,

banks have started auctioning properties of various MSME unit under the

SARFAESI (The Securitisation and Reconstruction of Financial Assets and

Enforcement of Securities Interest Act, 2002) Act,†Rajkumar informs.

In such cases, the only court the borrower can appeal to is

the Debt Recovery Tribunal. “But it takes more than a week after paying the requisite fee for the hearing to come up at the Tribunal in Madurai, whereas

the bank auction notice gives the MSME units only two weeks, with just 10

working days,†Rajkumar claims.

Under these circumstances, the borrowers are denied their

legal right to appeal against the bank action. Hence, the Centre should either

direct banks to stop all auctions until the pandemic is over or provide a

special channel for appeal, he demands.

Although the MSME sector is considered the backbone of the

country in view of the employment opportunities generated by it, proper

attention is not being bestowed on the needs of the sector, he regrets.

“The MSME sector in Tiruchi region has been in a crisis for

the last four years and the COVID-19 crisis has further aggravated the

situation for the NPA units that had provided huge employment for the last five

decades,†says Rajkumar.

Promoters who ran the units must be encouraged to form a

cluster to take bulk order and distribute among them for coming out of the

sickness successfully and early. The case of MSME NPA units in Tiruchi must be

given special consideration as they provided employment, paid taxes promptly

and followed other statutory obligations.

As they had become sick due to change in government policies

and general recession, sanction of additional limits at lower rate of interest

or interest subvention must be given.

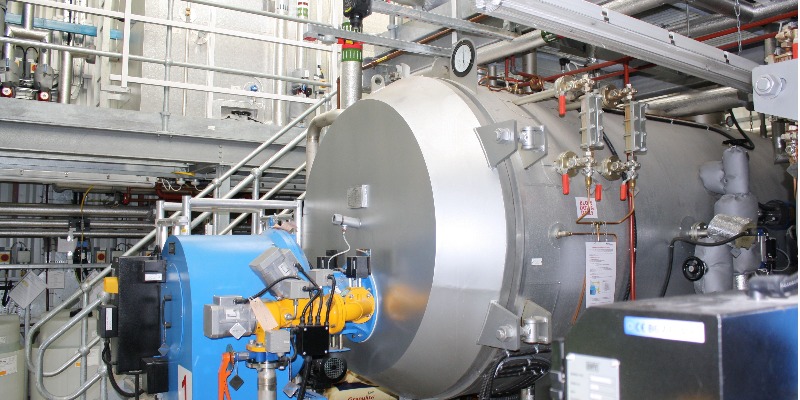

Tiruchi had been known as one of the best fabrication hubs

in South Asia. MSME units had acquired proficiency in fabrication and machining

of heavy and large equipment. Educated and highly skilled entrepreneurs had the

expertise for complicated jobs, and skilled and efficient labour was readily

available. All types of latest welding technology had been developed thorough

Welding Research Institute, BHEL, Tiruchi. The Tiruchi fabrication hub had the

manufacturing capacity of around seven lakh metric tonnes per annum, he believes.

BHEL Tiruchi had started getting orders. BHEL Ranipet had

got good orders for Flue Gas Desulfurisation from thermal plants for the next

four to five years. Also, Tiruchi had been identified as a hub for the production

of defence components as part of Defence Corridor. Tiruchi MSME units had

already formed various clusters for undertaking bulk orders from defence and

railways.

Those who wanted time must be permitted one year without

interest after receiving an initial payment of 10 per cent of the OTS amount

arrived. Those willing to run the unit in the existing form without further

investment, by making the OTS, must be sanctioned interest-free working capital

term loan, payable in a span of seven years with a moratorium period of one

year. Those needing additional facilities must be provided access to equity

funds by the government, and further back up by banks. Equity and facilities not

exceeding Rs 2 crore must be covered under credit guarantee scheme. The OTS

could also be converted into interest-free working capital loan payable in

seven years with a moratorium period of one year, Rajkumar states while

detailing about their demands.

Related Stories

Tech-Enabled Intra-City Logistics Boost MSME Efficiency

A C-DEP–IIT Delhi study shows how technology-enabled intra-city logistics is cutting costs, improving delivery reliability and expanding market reach for MSMEs, while flagging key GST and pol..

Read more

India–EU FTA sealed, offers preferential EU access to over 99% of Indian exports

The agreement is expected to be particularly transformative for labour-intensive sectors and MSMEs, with positive spillovers for employment generation among women, artisans, youth and professionals.

Read more

Building India’s Manufacturing Strength in a VUCA Environment

The 2021 chip shortage exposed structural weaknesses in India’s manufacturing model, underscoring the urgent need to shift from scale-led assembly to resilient, innovation-driven industrial ecosys..

Read moreRelated Products

Biomass and Coal Fired Spreader Stoker Boiler

Sitson India Ltd offers a wide range of biomass and coal

fired spreader stoker boiler

Coil Type Boilers - VRS Series

Maxima Boilers Private Limited offers a wide range of coil type boilers - VRS Series

Steam Boiler

Ambica Boiler offers a wide range of steam boiler.