Schedule a Call Back

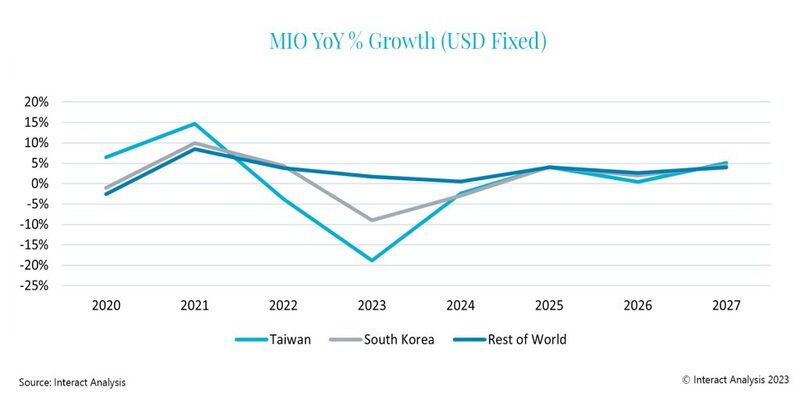

Semiconductors sales slump strikes South Korea and Taiwan

Industry News

Industry News- Aug 18,23

Adrian Lloyd is a 20+ year veteran of technology research and has pioneered many data analysis techniques that are used widely by analysts today. He brings his expertise to many technology markets from industrial automation products to semiconductors.

Related Stories

India’s Decarbonisation Journey: Turning Climate Challenge into Opportunity

While decarbonisation is increasingly becoming a prerequisite to access premium global markets, India's path to net-zero by 2070 is complex. However, with coordinated action, strategic investments, ..

Read more

Automation to Drive Packaging Machinery Market Surge

Rising labour costs, regulatory pressures, and the growing influence of e-commerce are driving the demand for end-of-line and warehousing packaging machineries. This growth is reshaping packaging st..

Read more

HD Hyundai appoints Chung Kisun as Chairman to drive next phase of global growth

This appointment reflects the company's determination to pioneer a new era under strong leadership amid an increasingly competitive and diversified global business environment.

Read moreRelated Products

Integrated Electric Gripper S Series

IBK Engineers Pvt Ltd offers a wide range of integrated electric gripper S series.

Geared Electric Motors

Delco Fans Pvt Ltd offers single phase capacitor run and three

phase geared Instrument motors, totally enclosed face/foot mounted.

“Kusam-Keco” Partial Discharge Acoustic Imager - Model - Km-pdai

‘Kusam-Meco’ has introduced a new “Partial Discharge Acoustic Imager Model KM-PDAI.