Schedule a Call Back

Russia-Ukraine war: 3 disruptions within motors & drives

Industry News

Industry News- Mar 28,22

The war that Russia has waged on Ukraine has rocked global commodity markets. While oil & gas supply disruption and the resulting increase in price continue to dominate headlines, there are a number of other key materials exported by Russia and Ukraine which have been equally disrupted. The disruption of many of these materials will have both direct and indirect impacts on costs associated with producing a motor or drive.

After the extremely turbulent price levels experienced around the world in 2021, further supply disruption off the back of conflict was the last thing the global economy needed. Unpacking the impact this will have on the most crucial areas of the motor & drive supply chain can help suppliers prepare their businesses for what is to come and manage the expectations of their customers as the situation continues to unfold.

Aluminium and copper wire supply to be disrupted

The impact on the supply of key materials is two-fold. First, the economic sanctions placed on Russia will impact its ability to sell various products to its historically largest customers. Second, the physical devastation experienced in Ukraine will impact its ability to produce and ship its key exports. As it pertains the production of motor and drives, the most direct impact stems from the disruption of aluminium and copper supply chains.

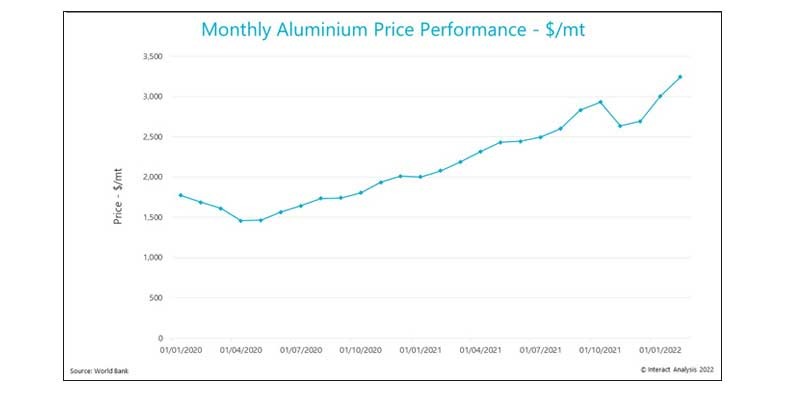

Russia is responsible for approximately 6% of the global aluminium supply according to CNBC. After significant COVID-19 related supply disruptions which resulted in a steady rise in price over 2021, it appeared that supply and demand were beginning to normalize in the last months of the year. In late 2021, the world bank had forecast a price increase of ~5% during 2022 for aluminium. Now that a war has broken out, Interact Analysis expects that price forecast to be on the conservative side. As shown below, the impact is already being felt with aluminium prices climbing to record highs in February this year.

We expect this price to climb even further as transportation costs continue to rise amidst the disruption of the oil supply.

The story for copper is not much different. While Russia is not as significant of a player in the raw copper market as it is in the aluminium trade, the country still produces nearly 0.5% of the world’s supply. While the price has not yet reached record highs, it likely will in May.

Perhaps more relevant is Russia’s role in the copper wire market. Nearly 7% of the world’s supply of copper wire, the same used in induction motors, comes from Russia. This will have an immediate and significant impact on the cost and availability of copper wire used in induction motors.

If you were to look at the bill of materials for an induction motor (including wages), copper and aluminium make up approximately 16% of the cost. The supply disruption these two commodities have seen due to war will be felt throughout 2022 in the form of a higher bill of materials. The motor market had already experienced significant price increases during 2021 as a result of increasing raw material costs. It would appear that price increases are likely to continue into 2022.

Neon? Like in the beer signs?

Yes, neon like in the beer signs. When one thinks of commodities impacting the drives market, Neon is not the first thing that comes to mind. However, the noble gas will likely play a significant role in the production of drives during 2022, albeit indirectly.

The semiconductor shortage has been a major concern for motor drive suppliers. Throughout 2021, the shortage of this key motor drive component caused delays in the production process resulting in extended lead times across the motor drive market. Neon gas, while not directly used in the manufacturing of motor drives, is used heavily in the production of semiconductor chips. The gas is used in the etching of silicon using high-powered lasers during the lithography step of the semiconductor production process.

According to an article by Reuters, two companies based out of Ukraine account for about half of the worlds neon supply. Both companies, Ingas and Cryoin, have shuttered operations amidst the Russian invasion. Resultingly, semiconductor suppliers, which are already facing a demand/supply imbalance, are now likely going to face additional production challenges stemming from a significant neon shortage.

Semiconductor suppliers (before the war) had pointed to Q4 2022 into Q1 of 2023 as the timeline for when the shortage of semiconductors would begin to resolve. Fortunately, many of these same suppliers have since reported stocking up neon supply ahead of the war. However, if the conflict does not resolve in a timely manner, these stockpiles could run out. Should this occur, the semiconductor supply could once again fall into disarray and drive suppliers would face sourcing problems similar to the ones at start of the semiconductor shortage in early 2021.

Final thoughts

As this war unfolds, we will continue to cover its impact on the markets we cover. Aluminium, copper, and neon are just three areas where this war will impact the production of motors & drives. There are undoubtedly impacts we have not touched on here including increased freight costs on the back of higher diesel prices, steel supply disruption, and the impact on end markets such as mining and oil & gas which are extremely large sectors within Russia and Ukraine. The impacts of this war are far reaching and we have only just begun to bear the consequences of Putin’s ill-intended actions.

About the author:

Blake Griffin is the Senior Analyst at Interact Analysis. He is an expert in automation systems, industrial digitalization, and off highway-electrification. Since joining Interact Analysis in 2017, he has written in-depth reports on the markets for low voltage AC motor drives, predictive maintenance, and mobile hydraulics. He can be reached on Email: blake.griffin@interactanalysis.com

Related Stories

Why Batteries Trail Strategy in Humanoid Robot Development

Battery makers are racing ahead of robot OEMs in positioning humanoids as the next growth frontier. This press release examines developments from both perspectives and considers how deeper cross-ind..

Read more

Copper Prices Hit Record Above $13,000 per Tonne

Supply fears and AI-led demand drive sharp rally

Read more

Taural India and TEIL Advance Marine Self-Reliance with Indigenous Gearbox Castings

Taural India has supplied TEIL with indigenously engineered aluminium castings used to manufacture propulsion gearboxes for an Indigenous Patrol Vessels Programme, marking a major step in marine sel..

Read moreRelated Products

Ph Fwd/ Rev Motor Protection Ssrs

Insys Electrical & Controls offers a wide range of PH FWD/ REV motor protection SSRs.

Commutator Motors

J D Automation provides a range of commutator motors, which are also

known as permanent magnet DC motors.

Compact Speed Vector Drives

Confident Automation offers compact speed vector drives.