Schedule a Call Back

Raymond expands engineering portfolio with MPPL stake acquisition for Rs 682 cr

Industry News

Industry News- Nov 03,23

Related Stories

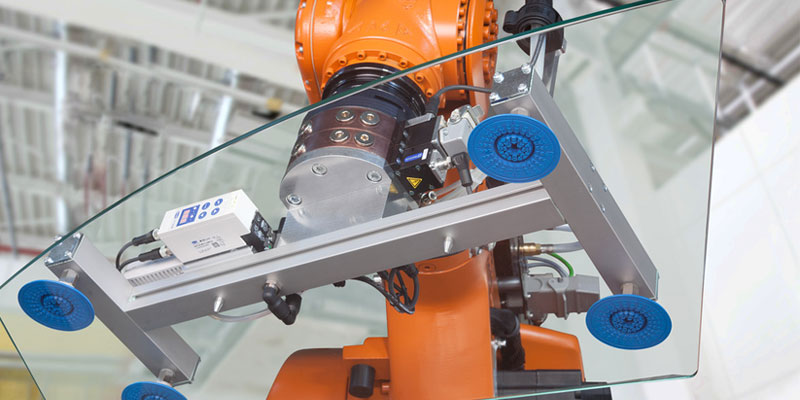

Air-Saving Vacuum Ejectors Cut Energy Use by Up to 90% in Automotive Plants

Air-saving vacuum ejectors are helping Indian automotive manufacturers reduce energy costs, cut carbon emissions and achieve rapid ROI while ensuring reliable, zero-defect production, shares Rajesh ..

Read more

Premji Invest Infuses Rs 3.0 Billion Equity into JS Auto Cast Foundry

Premji Invest acquires 23 per cent stake in JSA to support capacity expansion and industry consolidation.

Read more

Neolite ZKW Commissions New Automotive Lighting Plant in Pune

Neolite ZKW Lightings Limited has commissioned a new manufacturing and design facility in Pune to strengthen automotive lighting capabilities and support OEM customers across vehicle segments.

Read moreRelated Products

Heavy Industrial Ovens

Hansa Enterprises offers a wide range of heavy industrial ovens.

High Quality Industrial Ovens

Hansa Enterprises offers a wide range of high quality industrial ovens. Read more

Hydro Extractor

Guruson International offers a wide range of cone hydro extractor. Read more