Schedule a Call Back

Machine tools industry heading for a sharp growth

Industry News

Industry News- Dec 30,22

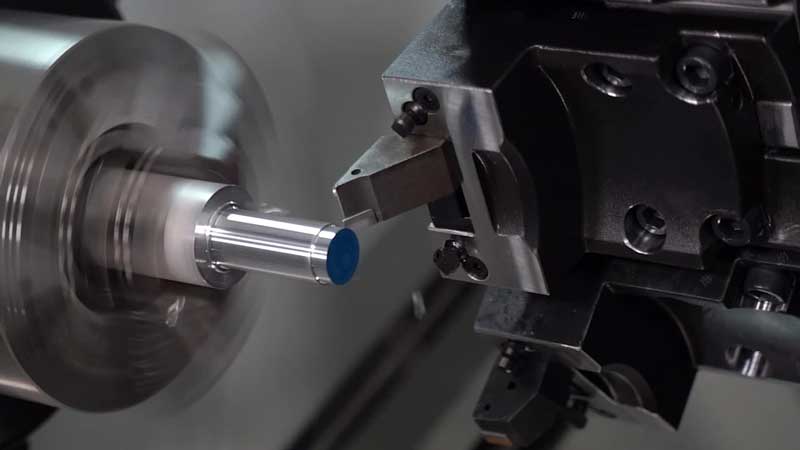

With vehicle sales and exports gradually gaining traction, Indian auto component industry demonstrated a remarkable performance in 2021-22. The auto component industry clocked highest-ever turnover of Rs 4.2 trillion in FY 2021-22 recording a growth of 23 per cent compared to Rs 3.41 trillion in FY 2020-21. Being the largest customer, sales of automotive and auto components have been the key demand drivers of growth for machine tool industry for decades. “We are witnessing an increase in vehicle production and supplies to dealers along with good demand from end consumers. Indian machine tool industry is strong when auto industry is strong and the recent surge in auto sales bodes well for machine tool industry,” informed Jibak Dasgupta, Director General & CEO, Indian Machine Tool Manufacturers’ Association (IMTMA).

According to Gardner Intelligence’s World Machine Tool Survey 2021, the Indian machine tool industry is ranked 8th in consumption and 11th in production, globally. “Indian machine tool production during FY 2021-2022 is estimated to have reached around Rs 93.07 billion and consumption is estimated to have reached around Rs 157.91 billion. Production is estimated to have increased by around 40 per cent year-on-year in 2021-22 and consumption is estimated to have increased by around 30 per cent year-on-year in 2021-22,” explained Jibak Dasgupta.

Rising machine tool sales is propelling demand for parts & accessories as well. “Indian machine tool industry today is growing in line with the Indian economy. Due to its domestic consumption, the global slowdown is not affecting it to the extent of other economies. We look to support this growth and would like to be a preferred source for many of the machine tool manufacturers and end users,” stated Deepak S Bhonsle, Managing Director, Rewdale Precision Tools – a manufacturer of precision tool holding collets and allied products.

Ashok Kocheril, CEO, Suhner India Pvt Ltd, added, “Indian machine tools industry is one of the fastest growing industries. The best companies of the world either have a manufacturing set up in India or a strong sales and service network. The home-grown companies are upping their quality levels and offerings to be at par with the rest of the world. The latest technologies in the industry are being made available in India without a time lag as in the past. Increase in the number of discerning customers gives Suhner an opportunity to bring solutions portfolio to India which was hitherto in demand only in Europe and America.”

Going beyond auto industry

The machine tool industry is presently facing bottlenecks pertaining to increase in cost of raw materials impacting margins, rise in fuel prices affecting logistics, and challenges in supply chain. “The geo-political situation in Europe is impacting manufacturing as prolonged war and sanctions will impact logistics, banking and business. Also, the availability and deployment of trained and skilled manpower in the era of digitalisation is a big challenge confronting the industry,” opined Jibak Dasgupta.

Indian machine tool industry imports high-end technology and large-size machines substantially. “To narrow this gap, we need to build inherent capabilities through intensive R&D and innovation. Fruitful collaboration between industry cohorts and academia when put to good use can nurture technology development resulting in industries enhancing their capacities to manufacture high-tech products, bring product diversification and help localisation of imports,” he added.

The onset of electric vehicles will pose some challenges to the manufacturers of auto component and machine tool. However, experts believe there will not be any threat in the near term as internal combustion engine (ICE) vehicles are still going strong with a good market share. Interestingly, metal forming industry has got good orders from the electric vehicle industry.

Ashok Kocheril explained, “With the onset of electric vehicles (EVs), we foresee demand of different types of components in the EV segment increasing in the two wheelers and four wheelers that replaces many of the internal combustion (IC) engine and diesel engine components.”

Though automotive industry has been the biggest customer of metalworking industry, machine tool makers are already diversifying into sunrise sectors such as agriculture machinery, construction equipment, electronics, medical devices, railways, aerospace and defence, etc, which are being promoted by government through various schemes. "There is a huge requirement for precision machined products from all sectors such as automobile, power generation (turbine machining), electronics, dental and medical implants to name a few. The machine tool industry in India is gearing up for this by developing machines with higher performance capabilities, so that Indian manufacturers need not import machine tools at high costs. Aerospace, medical implants and dental industries are potential users of our products. Wind power industry will have a huge requirement of precision machining solutions. Other infrastructure industries are also good markets for us," stated Deepak Bhonsle.

Aerospace is an emerging sector in India and, with the government devising indigenisation strategy for defence equipment manufacturing, the machine tools industry expects more orders to come its way. C S Shiva Shankaraiah, Managing Director, Trishul Machine Tools, the manufacturer of polygon turning machine, said, “We are upbeat on the prospects of machine tools industry in the country. With the aerospace industry gathering momentum and the China Plus One policy picking up pace, we look forward to a reasonably good growth in the coming years. We will be also concentrating on the oil & gas industry for our growth.”

Automation gaining traction

The requirement to reduce manual labour inputs is forcing manufacturers to look for ways to improve the bottom line and operational efficiency. Hence, manufacturers in India are adopting industrial automation. Ashok Kocheril said, “We believe that the use of robots in machining and surface finishing (grinding, deburring and polishing) will increase manifold in the coming years and this is an area that we see opportunities. The next few years could see use of robots in almost all spheres of machining increasing manifold. Automation is at the core of the solutions portfolio. Our solutions, be it with our spindles portfolio or robot portfolio is focussed towards automating manual operations. This gives the end customer a lower cost per piece which helps enhance his business. We are bullish on India, and we will be focusing to increase the footprint our toolholders portfolio to the Indian market in the coming years to take advantage of the machine tool industry’s growth momentum.”

Machine tool makers are aligning their business strategy to meet the requirements of their customers. “We provide automation solutions to few customers and, going forward, we plan to offer the IoT (Internet of Things) and Industry 4.0 features on our machines. We expect the demand for automation to go up in the future and we are equipped for this,” commented Shiva Shankaraiah.

Brighter 2023

Initiatives such as the PLI schemes, identification of champion sectors, increased FDIs in strategic sectors, reforms towards ease of doing business, reduction of corporate tax rates, etc augurs well for Indian machine tool manufacturers. According to experts, the order book position, an indicator of growing consumption, looks positive for 2022-23. Ravi Raghavan, President of IMTMA and MD of Bharat Fritz Werner (BFW), said, “As far as machine tool industry is concerned, we have a large domestic market where demand is steady. This apart, the government thrust on infrastructure development, business from PLI industries is propelling the economy from recessionary pressures. Also changing geo-political situation would benefit India’s machine tool business.”

With the green shoots being evidently visible, business prospects of the machine tools industry is expected to improve in the coming quarters. A key indicator to this is the performance of the auto component industry. The turnover of the automotive component industry stood at Rs 2.65 trillion ($33.8 billion) in the first half (H1) of 2022-23, registering a growth of 34.8 per cent over H1 FY 2021-22.

Ravi Raghavan elaborated, “Indian machine tool industry has been doing well in terms of consumption and production. The half-yearly results have been good, and the forthcoming quarters also look promising with some good order bookings in spite of the geopolitical and economic slowdown on the anvil. India’s production for April to September period FY 2022-23 is estimated to have reached Rs 42.86 billion and consumption during this period is estimated to have reached Rs 99.06 billion.”

Related Stories

How to Double Fabrication Capacity Without Expanding Your Factory Footprint

Rising demand and costly expansion are pushing fabricators to rethink growth. Vertical automation unlocks hidden capacity within existing shop floors, says Emily Newton.

Read more

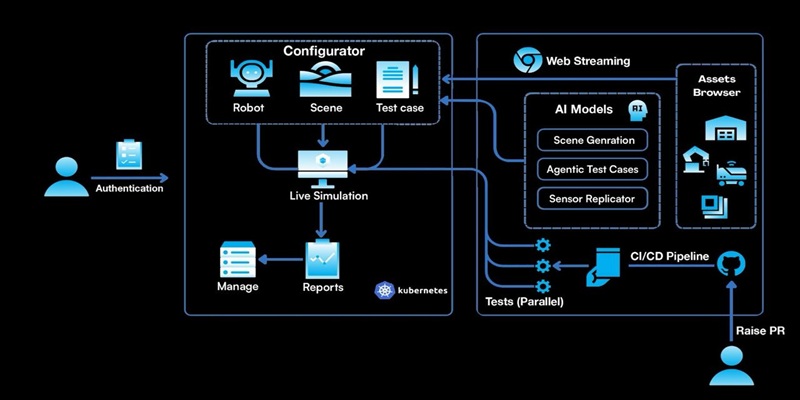

Addverb Expands Robotics Workflow with NVIDIA AI Platforms

Addverb enhances its robotics development workflow using NVIDIA AI, simulation and edge platforms to accelerate design, training and deployment of industrial robots

Read more

Harting Launches PushPull V4 Power QuickLock Connectors

Harting unveils PushPull V4 Power QuickLock connectors with Han QuickLock technology for fast, tool-less field assembly in compact industrial and outdoor applications.

Read moreRelated Products

Precision Cutting Tools1

S S Trading Corporation offers a wide range of precision

cutting tools.

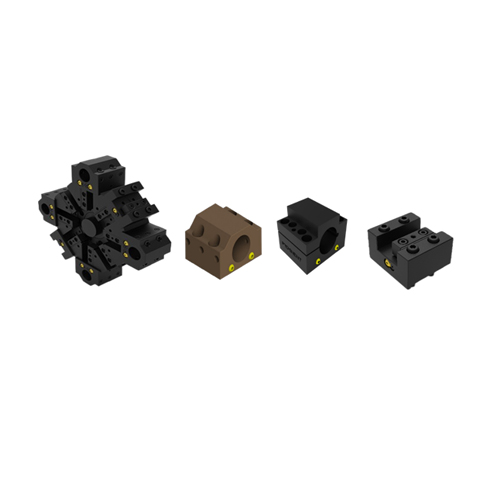

Slotting Head Unit for All Cnc Turn Mill Centers

Sphoorti Machine Tools Pvt Ltd offers a wide range of

slotting head unit for all CNC turn mill centers.

Slotted Tool Disc and Tool Holders

Prominent Machine Tools offers a wide range of slotted tool disc and tool holders.