Schedule a Call Back

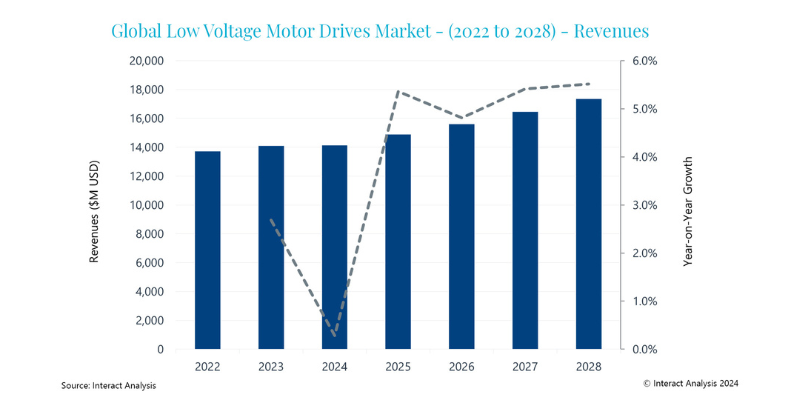

Low voltage AC drive shipments exceed 20 m in 2023

Industry News

Industry News- Feb 08,24

Related Stories

Why Batteries Trail Strategy in Humanoid Robot Development

Battery makers are racing ahead of robot OEMs in positioning humanoids as the next growth frontier. This press release examines developments from both perspectives and considers how deeper cross-ind..

Read more

Tariffs are reshaping automation supply chains: Blake Griffin

In this interview, Blake Griffin, Research Manager, Interact Analysis, highlights how trade wars, geopolitical tensions and rare-earth restrictions are reshaping global automation industry.

Read more

Can AI be the game changer for Indian manufacturers?

While manpower issues and quality are driving adoption of industrial automation, cost and lack of knowledge are causing hindrances. Artificial intelligence (AI) can be the game changer, writes Rakes..

Read moreRelated Products

Integrated Electric Gripper S Series

IBK Engineers Pvt Ltd offers a wide range of integrated electric gripper S series.

Geared Electric Motors

Delco Fans Pvt Ltd offers single phase capacitor run and three

phase geared Instrument motors, totally enclosed face/foot mounted.

“Kusam-Keco” Partial Discharge Acoustic Imager - Model - Km-pdai

‘Kusam-Meco’ has introduced a new “Partial Discharge Acoustic Imager Model KM-PDAI.