Schedule a Call Back

IREDA, Bank of Maharashtra join forces to boost renewable energy financing

Industry News

Industry News- Sep 21,23

Related Stories

US Tariff Cut Lifts Apparel Outlook; Diamonds Stay Negative: ICRA

ICRA says US tariff cuts to 18 per cent offer relief to exporters, restores Stable outlook on apparel, but retains Negative outlook on cut and polished diamonds.

Read more

Stellantis, Tata Motors Mark 20 Years of FIAPL Partnership

Stellantis and Tata Motors Passenger Vehicles celebrate 20 years of FIAPL and sign an MoU to expand collaboration in manufacturing, engineering and supply chain.

Read more

KWV Secures Rs 0.42 Billion Under Maharashtra EV Policy

Kinetic Watts & Volts will receive ?42 crore in phased incentives under Maharashtra’s EV Policy to expand robotics-led manufacturing and battery assembly for the Kinetic DX EV.

Read moreRelated Products

Power Conversion Systems

POM Systems & Services Pvt Ltd offers a wide range of

PCS power conversion systems energy storage.

Hot Water Generators

Transparent Energy Systems Private Limited offers a wide range of Hot water generators - Aquawarm Superplus.

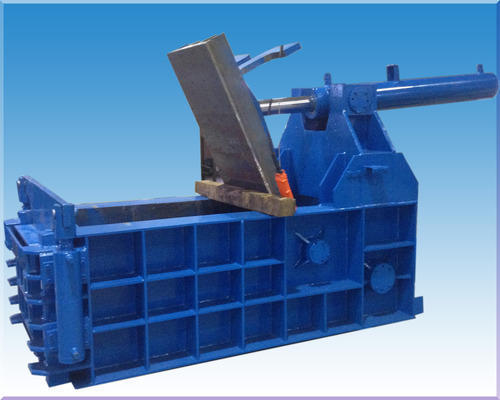

Scrap Baling Press

Fluid Power Machines offers hydraulic scrap baling press. Read more