Schedule a Call Back

Govt proposes deferring BS-VI norms for construction equipment

Industry News

Industry News- Jun 25,20

In a bigger development on the construction equipment front, the Ministry of Road Transport and Highways has proposed to defer the BS-VI emission norms on receiving requests and suggestions from the various equipment manufacturers. The compliance of this emission norm is expected to move to April 2021.

The ministry’s proposal includes equipment such as tractors, harvesters and construction equipment vehicles. The ministry is considering this as an attempt to offer relief to the agriculture and infrastructure sectors amid the Covid-19 crisis.

Construction equipment manufacturers, as well as manufacturers of vehicles used in agriculture had to adhere to Bharat Stage (BS) VI norms from October 1, 2020.

While, for all on-road vehicles like two and three wheelers and four wheelers and others, a transition from BS-IV to BS-VI was made mandatory from April 1, 2020, rules for off-road vehicles were not the same.

There has been a request from the agriculture ministry, construction equipment manufacturers, to provide some time to implement the BS-VI emission norms.

The transition to BS-VI was supposed to happen from October 1, 2020. However, due to the Covid-19 outbreak, the ministry is considering the deferment of BS-IV emission norms till March 31, 2021, and have invited suggestions from stakeholders, the official said.

The Covid-19 crisis and a nationwide lockdown to contain had brought economic activities to a grinding halt, putting several businesses under liquidity crunch. The proposal, if implemented, will defer higher expenses related to BS-VI norms for the manufacturers, dealers, while benefiting road builders, farmers, among others. The construction sector in India is considered to be the second-largest employer and contributor to economic activity.

Speaking on why postponing the compliance is significant, Puneet Vidyarthi, Brand Leader, CASE India, expressed, “COVID 19 has been an unprecedented occurrence and has affected businesses worldwide. It has impacted multiple aspects of a business such as manufacturing, supply chain, sales, etc. which have been affected since all the commercial activities came to a sudden halt. The markets are a little sluggish.â€Â

CASE India’s finance arm, CNH Capital, has boosted its capital availability giving a big boon for customers who wish to make any purchases. Vidyarthi adds, “We’re hopeful the next quarter will be better and CASE will hit the ground running.â€Â

Amid this, other challenges like rusting, loss of efficiency, maintenance etc will pose as bigger hurdles while activities resume,.

Explore the construction sector in times of COVID and ways to recovery.

Related Stories

SANY India Opens New 3S Branches in Visakhapatnam and Palwancha

The inauguration ceremonies were attended by senior leaders from SANY India.

Read more

India’s Construction Equipment Bestsellers

Lifetime honours for Anand Sundaresan, Ammann India and Person of the Year for Vivekanand Vanmeeganathan, Caterpillar among industry bestsellers

Read more

Ammann India Expands ABG Paver Production and Aftermarket in Gujarat

Ammann India rolls out its first ABG Paver and launches a high-tech parts warehouse in Gujarat, boosting local manufacturing, service support, and exports for road construction equipment.

Read moreRelated Products

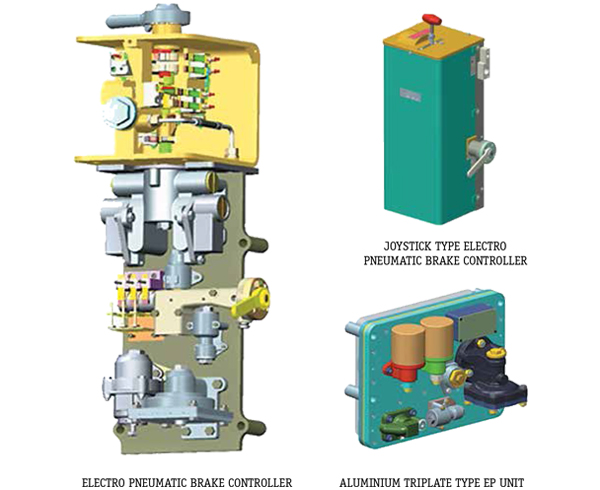

Electro - Pneumatic Brake System for Emu

Escorts Kubota Limited offers a wide range of electro - pneumatic brake system for EMU.

Indef Powered Crane Kit

Hercules Hoists Ltd offers a wide range of Indef powered crane kit.

Jib Crane

DC Hoist & Instruments Pvt Ltd offers a wide range of Jib crane.