Schedule a Call Back

Global manufacturing industry is limping in the right direction

Industry News

Industry News- Oct 03,21

This insight, drawn from the latest update of our Manufacturing Industry Output tracker (MIO), zooms in on some specific issues identified by our researchers as global manufacturing makes uneven progress on the path to recovery from the shock of COVID-19. Key factors which make forecasting in this MIO update a particular challenge include the semi-conductor shortage, labour shortages, high freight costs, the continued spread of the delta variant, and a slow vaccination roll-out as well as vaccine hesitation. In this article we focus on two of those factors – chip shortages and freight costs – and we take a look at machinery production (traditionally a more volatile sector than industry production) where cautious capital investments in some segments have meant particularly slow recovery for some machinery manufacturers, whilst others are making good progress towards market normality.

A perfect storm for semiconductor supply

The long running semiconductor shortage saw strains on supplies caused by booming sales in electronic devices at the height of the pandemic. Additionally, the automotive sector has been a major contributor to the shortage because, as vehicle manufacturers anticipated a slow-down in demand for new vehicles, so they put the brakes on production and reduced orders for microchips. But when the slow-down in demand didn’t happen, car companies couldn’t get chips fast enough, leaving factories full of chip-less cars.

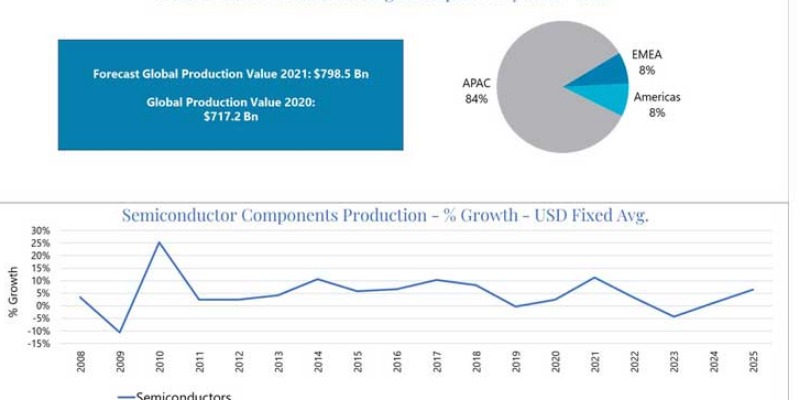

The slowness of supply chains for semiconductor chips – it can be 7 to 8 months between order and delivery – means that this isn’t a problem which is going to go away anytime soon. Not good news for industries that have already taken a battering. The approval of COVID-19 vaccines – a cause for celebration for most of us – has further exacerbated the chip shortage because vaccine vial production caused huge demand for the same raw silicon that is used in microchips. All-in-all, it’s been a perfect storm. The current boom in demand for semiconductors means we are predicting that the market will see a downturn in late 2023 or early 2024, because the glut of orders from manufacturers will inevitably diminish as their chip inventory builds up once more (refer Figure 1).

Over the long term, one impact of this has been big conversations at government level in the USA and the EU about the need for onshoring of some semiconductor production. If it happens, this will be a long-term trend, and so will do nothing to solve immediate problems. But, for example, Intel has announced that it will invest $20bn in two new chip plants in Arizona, and TSMC is also investing $12bn in a chip production facility in the same state.

Freight rates up 500%

The cost of shipping a 40-foot container from China to the US East coast reached $20,000 in July 2021. This is five times more expensive than in July 2020. The Financial Times has reported that the cost of shipping a single container from Asia to Europe increased by $6,000 between April and August 2021 alone, and ocean freight costs between East Asia and the US west coast are rising at a rate of 20%, month on month. Furthermore, there are reports that container shipping services are deteriorating – with regular mistakes and delays, such as containers being left off ships, causing disruption to supply chains. Unsurprisingly, the pandemic is the root cause of the surge in pricing and the disruption, with ships being delayed by COVID-19, outbreaks in major Chinese manufacturing hubs, ports across the globe experiencing goods overload as e-commerce spirals, and ports also experiencing lack of manpower owing to infection rates. The Suez Canal blockage and typhoons off China’s busy southern coast in July and August have not helped matters.

These freight issues have combined together to have a significant impact on the market performance of manufacturers. In the apparel sector, for example, Nike last March reported a drop in sales not because of a lack of demand but owing to a shortage of shipping containers and delays to shipments. We anticipate this problem will continue, likely mainly affecting the clothing and electronics sectors, as supply chains continue to break down in the face of increasing demand. Will these issues around shipping eventually feed into the trend for increased near-shoring or re-shoring of manufacturing? A future MIO might be reporting on that phenomenon, but it is not for consideration in the short term.

Global machinery market to grow to $2.11 trillion in 2021

After a global shock hits, manufacturers become cautious and risk-averse. New projects and planned investments are often postponed or shelved. When this happens, segments of the industrial machinery sector are inevitably a casualty. As the pandemic swept across the globe in 2020, the hardest hit machinery sector was machine tools as big customers such as automotive and aerospace slowed or ceased production, impacting main assembly lines and associated component makers all the way through the supply chain. Orders for machine tools slumped by 18% that year. But COVID 19 didn’t have a negative impact on all machinery sectors. We’ve already talked above about the huge demand for microchips. In 2020, the market for semiconductor and electronics machinery grew by 8% and the latest data from SEMI, the global industry association representing electronics manufacturing indicates that this growth is likely to continue.

Figure 2 visually represents our projections for the main machinery categories. We expect them all to recover to 2019 levels (represented by the vertical orange broken line) by 2025, but while some segments, such as metallurgy machinery, will cross the 2019 line early (i.e. this year), the recovery for machine tools is predicted to be a stuttering one. Note also the anticipated steep dip in 2023 for semiconductor machinery, owing to the aforementioned decline in orders for semiconductors from big customers.

China alone currently accounts for 40% of global machinery production, and Asia as a whole 61%, with Europe clocking up 26% and the Americas a mere 13%. We have estimated the value of the global machinery market in 2020 as standing at $1.98 trillion, and we expect this to rise to $2.11 trillion in 2021, surpassing 2019 levels. This represents a 6.2% recovery in machinery production in 2021, when we anticipate seeing dedicated, multi-industry and non-manufacturing machinery segments achieve a 2021-2025 CAGR of between 3% and 4%. The machinery segments seeing the highest CAGRs are predicted to be: mining machinery (5.3%), farming machinery (5.1%), materials handling equipment (4.7%) and textile machinery (4.5%).

About the author:

Adrian Lloyd is the CEO of Interact Analysis. He is a 20+ year veteran of technology research and has pioneered many data analysis techniques that are used widely by analysts today. He brings his expertise to many technology markets from industrial automation products to semiconductors. He can be reached on email: adrian.lloyd@interactanalysis.com

Related Stories

EFTA Commits $100 Billion Investment in India: Goyal

Goyal says EFTA to invest $100 billion in India’s innovation and manufacturing.

Read more

Tariffs are reshaping automation supply chains: Blake Griffin

In this interview, Blake Griffin, Research Manager, Interact Analysis, highlights how trade wars, geopolitical tensions and rare-earth restrictions are reshaping global automation industry.

Read more

Indian machine tools sector is poised for strong expansion: Rajesh Mandlik

During the recent press meet in Mumbai for IMTEX Forming 2026 (which will be held from January 21–25 in Bengaluru), Rajesh Mandlik, CEO of Setco Spindles India, discusses with Rakesh Rao growth op..

Read moreRelated Products

Carbide Burrs

SRT Industrial Tools & Equipments offers a wide range of carbide burrs.

Jamshedji Soil Compactor

Jamshedji Constro Equip Pvt Ltd offers a wide range of jamshedji soil compactor.

Ground Pins

Hans Machineries Private Limited offers a wide range of pins, hardened & ground. Read more