Schedule a Call Back

Global battery manufacturing equipment market to reach $30 billion by 2029

Articles

Articles- Nov 12,24

Related Stories

KWV Secures Rs 0.42 Billion Under Maharashtra EV Policy

Kinetic Watts & Volts will receive ?42 crore in phased incentives under Maharashtra’s EV Policy to expand robotics-led manufacturing and battery assembly for the Kinetic DX EV.

Read more

New Opportunities in EV Manufacturing Amid Market Flux

India’s EV journey is entering a decisive phase, shifting from policy-led adoption to a focus on manufacturing depth, technology ownership, indigenisation and global competitiveness, shares Dr Uda..

Read more

Laser technology is fundamentally transforming manufacturing: Hrishikesh Sawant

In this interview, Hrishikesh Sawant, Director, C and C Laser Engineering Pvt Ltd, explains how the company is addressing India’s growing demand for high-end laser solutions with a strong focus on..

Read moreRelated Products

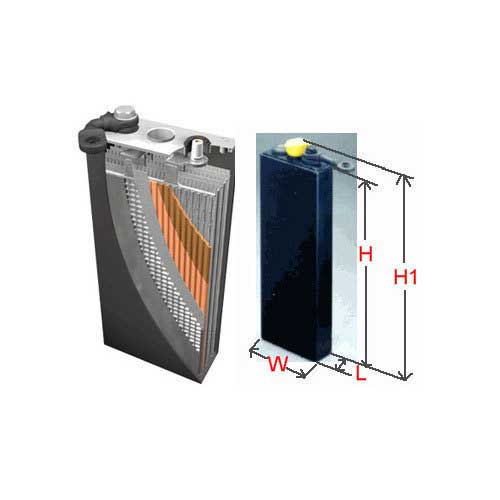

Forklift Battery

Aatous International is a manufacturer and solution provider of a wide range of forklift battery.

Kusam Meco -Wrist Type High Voltage Alarm

‘KUSAM-MECO’ has introduced a new wrist Type High Voltage Alarm Detector - Model KM-HVW-289 having a wide sensing range from 1kV-220 kV AC.

Servotech Power Systems files 2 patents for energy management technologies

Servotech Power Systems, a leading manufacturer of EV chargers and solar solutions, has announced that it has filed two patents for innovative energy management technologies in order to facilitate gri Read more