Schedule a Call Back

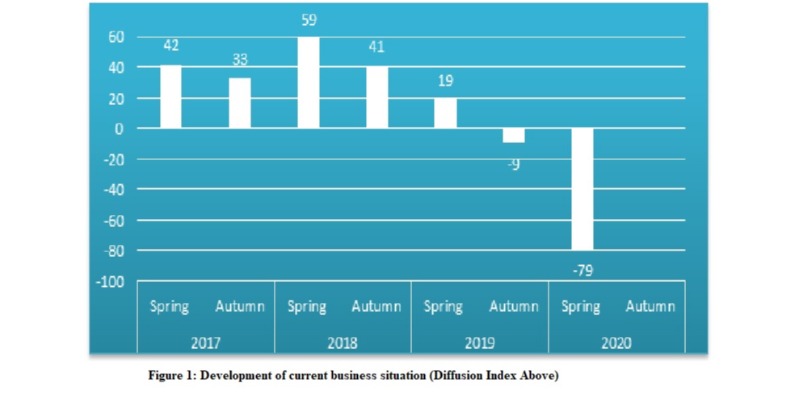

German firms more pessimistic about India than 6 months back, says VDMA survey

Industry News

Industry News- Jun 19,20

Related Stories

More safety in cleanrooms with igus’ new polymer ball bearings

The company is adding abrasion-resistant xiros ball bearings to its portfolio for semiconductor manufacturing and battery production

Read more

Germany's Barnes Molding Solutions Opens $30 Mn Greenfield Facility in Pune

New Chakan plant strengthens Barnes Molding Solutions’ Asia strategy with local manufacturing and service capabilities.

Read more

German Chancellor Friedrich Merz Visits Bosch India Campus in Bengaluru

German Chancellor Friedrich Merz visited Bosch’s Bengaluru campus, highlighting India–Germany collaboration in innovation, hydrogen mobility and advanced manufacturing.

Read moreRelated Products

Flexible Shaft Drivesc

PFERD offers a wide range of flexible shaft drives ME22/150.

Hydraulic Transmission Drives

INI Hydraulic Co Ltd offers a wide range of Hydraulic Transmission Drives IY Series.

Transmission Discs And Steel Mating Plates

Friction Elements, an ISO 9001-2015 company, manufactures wide range of transmission discs & steel mating plates. These wet and dry friction materials such as sintered bronze, carbon, ceramic, grap Read more