Schedule a Call Back

Geared motors market on a smooth ride

Industry News

Industry News- Feb 02,22

How many times have you changed gear when you’re driving without thinking what’s happening under the floor? The gearbox, the unsung hero of the drivetrain, is also an essential industrial component because it offers enhanced motion control and enables smaller motors. Our new research on the geared motors and industrial heavy duty gears market highlights important trends for a range of equipment types, including light-duty geared motors and solo gearboxes, parallel and bevel heavy duty geared products and planetary geared machinery.

Pent-up demand from 2020 brought 8.4% growth in 2021

2020 was a difficult year for the geared products sector. Overall, the market declined by 2.4%, Asia-Pacific (excluding Japan) being the only region to see positive growth – 5% year-on year. EMEA, the Americas and Japan saw contractions of 7.2%, 6.9% and 8.2% respectively. Asia-Pacific, with its huge industrial base, including China, the world’s largest single country market, accounted for 47% of global market revenues in 2020. Meanwhile, EMEA claimed a 34% share, and the Americas accounted for 19%.

As we progressed into 2021, demand for geared products increased, and revenues rose owing to supply-chain disruption. We estimated 8.4% YoY growth in the global market for geared products in 2021, but things will level off from 2022 onwards. The lowest rate of growth will be in 2023, when we anticipate renewed uncertainties regarding economic growth and investment: the usual up-and-down market cycle. Out to 2025, the market is forecast to grow with a CAGR of 5% in Asia-pacific, and 4.7% in the Americas and EMEA.

Light-duty geared products are market leaders

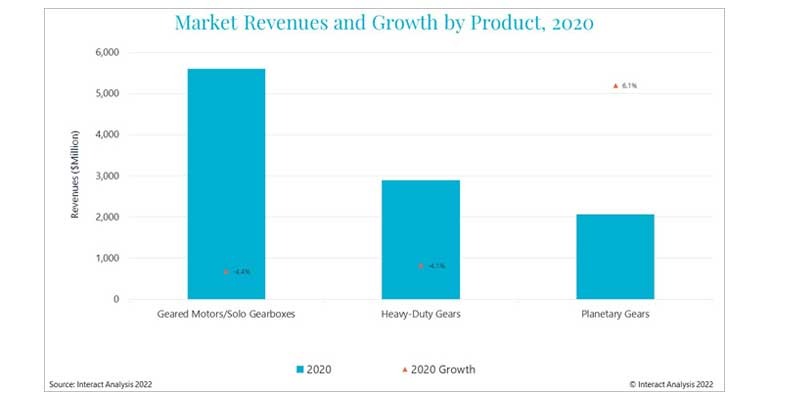

In 2020, geared motors and solo gearboxes were the leading product category, accounting for 53% of total global revenues, but sales were down by 4.4% and sales of heavy duty geared products (with a 27% market share) saw a 4.1% contraction. It goes without saying that these dips were due to slow downstream demand from companies slashing investment in the teeth of the pandemic.

The only product group achieving year-on-year growth in 2020 was planetary geared equipment. This 6.1% growth was mainly due to the surge in demand for planetary gears for use in pitch, yaw, and azimuth applications in the wind turbine industry, notably in China and the USA. We forecast 4.8% annual growth out to 2025 for the geared motors and heavy-duty gears market, when we expect annual revenues to be $14,165 million. Breaking that market up a bit, we expect light-duty products to grow with a CAGR of 5.5% over the forecast period, planetary geared products 5.2%, and heavy-duty geared equipment seeing the lowest CAGR – 3.8%.

Sales to warehouse and parcel sectors expected to boom

Machinery manufacturers are the main consumers of geared products. In 2020, they accounted for 74% of revenues. We predict revenues from sales to the machinery sector to grow with a CAGR of 4.8% out to 2025. Of all machinery producers, conveyor manufacturers were by far the largest market for geared products in 2020, providing an estimated 24% of total revenues. Sales to this sector are expected to see above-average growth out to 2025, with a CAGR of 6.8%, the drivers being the logistics and factory automation sectors.

Where end-user industries are concerned, food and beverage came in at number one, with 14% of revenues. But revenues from the sector will grow with a below average CAGR of 4.4% through the forecast period, while the warehouse and parcel sector is expected to achieve an impressive CAGR of 10.4%, as it benefits from the changes to consumer buying habits accelerated by the COVID-19 pandemic, which is causing a spike in demand for automated solutions.

About the author:

Shirly Zhu is the Principal Analyst at Interact Analysis. She is primarily focused on Industrial Automation topics including motion and industrial controls. He can be reached on email: shirly.zhu@interactanalysis.com

Related Stories

Tariffs are reshaping automation supply chains: Blake Griffin

In this interview, Blake Griffin, Research Manager, Interact Analysis, highlights how trade wars, geopolitical tensions and rare-earth restrictions are reshaping global automation industry.

Read more

AI on the edge will transform the shop floor: Sameer Gandhi

In this interview with Rakesh Rao, Sameer Gandhi, MD, OMRON Automation Pvt Ltd, elaborates on trends and opportunities as the manufacturing sector opts for data-led decision-making, quality and safe..

Read more

Automation is accelerating structural shift in Indian manufacturing: Atul Patil

In this interview, Atul Patil, GM – Marketing, FA Systems, Mitsubishi Electric India, explains how are automation technologies—robots, cobots and digitalisation—reshaping Indian manufacturing...

Read moreRelated Products

Auto Wheel Hub Bearings

Kasuma Auto Engg Pvt Ltd offers a comprehensive range of Auto Wheel Hub Bearings.

Gear Lever Kits

B S Industry offers a wide range of gear lever kits.

Automotive Gear

Matrix Precision Engineering offering a personalized array of automotive gear.