Schedule a Call Back

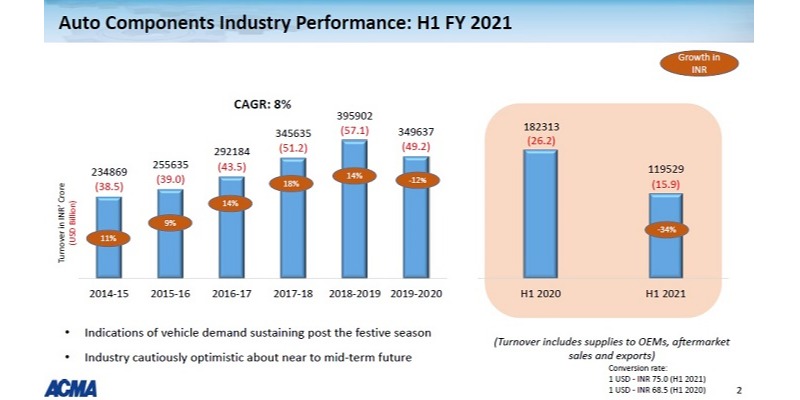

For the first time India’s auto component exports exceed imports

Industry News

Industry News- Dec 16,20

- Exports: Exports of auto components declined by 23.6 per cent to Rs 390 billion ($ 5.2 billion) in H1 2020-21 from Rs 510.28 billion ($ 7.4 billion) in H1 2019-20. Europe accounting for 31 per cent of exports, saw a decline of 28 percent, while North America and Asia, accounting for 30 per cent and 29 per cent respectively also registered decline of 28 and 30 per cent respectively. The key export items included drive transmission & steering, engine components, Body/Chasis, Suspension & Braking, among others.

- Imports: Imports of auto components decreased by 32.7 per cent to Rs 377.10 billion ($ 5.0 billion) in H1 2020-21 from Rs 560.66 billion ($ 8.2 billion) in H1 2019-20. Asia accounted for 60 per cent of imports followed by Europe and North America, with 30 per cent and 9 per cent respectively. Imports from all geographies witnessed steep decline.

- Aftermarket: The aftermarket in H1 2020-21 witnessed de-growth of 15 per cent to Rs 311.16 billion ($ 4.1 billion) from Rs 366.07 billion ($ 5.3 billion) in H1 2019-20.

Related Stories

Project execution in a VUCA world: Mitigating cost and time escalation

Projects today must succeed despite uncertainty, not in the absence of it. Project execution now demands resilience, digital intelligence and lifecycle integration to control cost and schedule risks..

Read more

Rewarding Manufacturing Resilience

Effective January 1, 2026, Mexico imposed import duties ranging from 5 per cent to 50 per cent on a broad set of goods from non-free trade agreement (FTA) countries, including India, China, South Ko..

Read more

Engineering India’s Next Phase of Growth with Responsibility: Amit Sharma

Amit Sharma, MD and CEO, Tata Consulting Engineers (TCE), outlines TCE's strategy to support India’s next phase of industrial growth through integrated engineering, nuclear and digital capabilitie..

Read moreRelated Products

Automotive Oil Pump

Kalpak Auto Pvt Ltd offers a wide range of

automotive oil pump.

Tata Motors unveils facilities for development of Hydrogen propulsion tech

Tata Motors, India?s largest automobile company, unveiled two state-of-the-art & new-age R&D facilities for meeting its mission of offering sustainable mobility solutions. The unveilings constitute of Read more

Tata Motors plans petrol powertrain for Harrier and Safari SUVs

Tata Motors is in the process of developing a new petrol powertrain for its premium sports utility vehicles, the Harrier and Safari, as confirmed by a senior company official. Currently, these models Read more