Schedule a Call Back

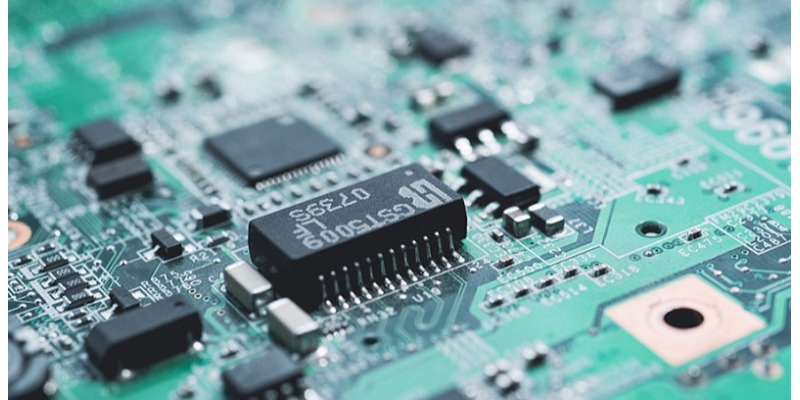

Extend PLI scheme to MSMEs to boost electronic manufacturing in India: Study

Industry News

Industry News- Nov 06,20

Related Stories

Electronics Sector Targets USD 500 Bn Output by 2030

India’s electronics industry expects strong growth driven by FTAs and incentives.

Read more

India’s Solar Module Capacity to Cross 125 GW, Raising Surplus Fears

Industry faces overcapacity risks as production triples domestic demand

Read more

Centre Launches Third Round of PLI Scheme for Speciality Steel

Scheme aims to boost high-end steel capacity and global competitiveness

Read moreRelated Products

Integrated Electric Gripper S Series

IBK Engineers Pvt Ltd offers a wide range of integrated electric gripper S series.

Geared Electric Motors

Delco Fans Pvt Ltd offers single phase capacitor run and three

phase geared Instrument motors, totally enclosed face/foot mounted.

“Kusam-Keco” Partial Discharge Acoustic Imager - Model - Km-pdai

‘Kusam-Meco’ has introduced a new “Partial Discharge Acoustic Imager Model KM-PDAI.