Schedule a Call Back

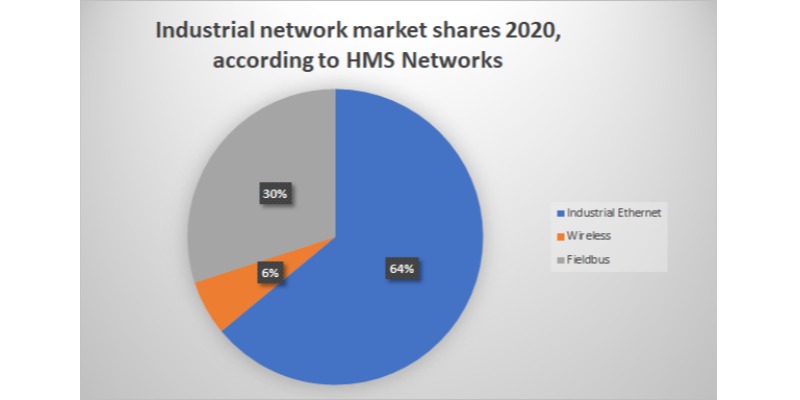

Ethernet tops industrial network market, fieldbus decline continues, says HMS Networks

Industry News

Industry News- Jun 10,20

Related Stories

End-of-Line Automation in an Era of Volatile Manufacturing Operations

Manufacturers face labour volatility, stricter compliance, and rising delivery expectations, making resilience as critical as efficiency. End-of-line automation is emerging as a strategic foundation..

Read more

AI on the edge will transform the shop floor: Sameer Gandhi

In this interview with Rakesh Rao, Sameer Gandhi, MD, OMRON Automation Pvt Ltd, elaborates on trends and opportunities as the manufacturing sector opts for data-led decision-making, quality and safe..

Read more

Automation is accelerating structural shift in Indian manufacturing: Atul Patil

In this interview, Atul Patil, GM – Marketing, FA Systems, Mitsubishi Electric India, explains how are automation technologies—robots, cobots and digitalisation—reshaping Indian manufacturing...

Read moreRelated Products

Digimatic Smart Caliper

Veekay Industries offers a wide range of digimatic smart caliper.

Compact Fmc - Motorum 3048tg With Fs2512

Meiban Engineering Technologies Pvt Ltd offers a wide range of Compact FMC - Motorum 3048TG with FS2512.

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.