Schedule a Call Back

Demand surge in Indian battery market underscores pressing need for action

Industry News

Industry News- Mar 30,24

The rapid expansion of the electric vehicle and energy

storage markets in India is driving development of the domestic battery

industry. However, insufficient capacity of domestic battery cell production

and shortages of raw materials have become key factors limiting its growth. In

order to break this deadlock, the Indian government has introduced incentive

policies aimed at accelerating the localisation of battery cells, attracting

domestic and foreign companies to invest in building battery factories. Despite

active responses from domestic companies and strong interest from overseas

manufacturers in the Indian market, issues related to domestic industry

protection and the business environment remain obstacles, resulting in

relatively slow development of the domestic battery industry chain.

India’s domestic

electric vehicle market is flourishing

In 2019 the Indian government’s NITI Aayog policy think tank

set a target to increase the proportion of electric passenger vehicles to 30

per cent and electric commercial vehicles to 70 per cent by 2030, and the

Indian government began promoting the development of electric vehicles more

actively in 2021, after signing the Paris Agreement on climate change. However,

despite government support and rising global demand for new energy vehicles,

actual progress has been relatively slow.

In order to protect the domestic automotive industry, the

Indian government has imposed high tariffs on imported electric vehicles: tariffs

of up to 70 per cent for imported electric vehicles priced below $40,000, and

tariffs of 100 per cent for those priced above $40,000. Although this was

intended to encourage overseas manufacturers to localise production, the result

has been to deter leading electric vehicle manufacturers such as Tesla. This

has contributed to a slow development process in the Indian electric vehicle

market, particularly given the relative weakness of domestic manufacturers. As

of 2023, the penetration rate of electric vehicles in India was only 6.6 per

cent, with electric passenger cars accounting for approximately 1.7 per cent of

the market, falling significantly short of targets. However, this also implies

significant untapped potential in the Indian electric vehicle market.

As shown in the figure below, the electric vehicle market in

India is still dominated by electric two-wheelers and three-wheelers, with

electric four-wheelers and electric buses accounting for a relatively small

proportion. Although from 2019 to 2023 the CAGR of these two categories

exceeded that of electric two-wheelers and three-wheelers, reaching 102 per

cent, it was not until 2023 that the combined proportion of electric

four-wheelers and electric buses surpassed 5 per cent.

At the end of 2023 the Indian government stated its

intention to gradually implement policies that will reduce import duties on

vehicles, but specific details and implementation plans have not yet been

released. With the policy still unclear, leading electric vehicle manufacturers

like Tesla are still in wait-and-see mode. However, the potential of the Indian

electric vehicle market has also attracted some automakers to enter the scene.

For instance, in February of this year Vietnamese electric vehicle company

Vinfast announced the start of construction on its automotive factory in

southern India.

The potential of the

energy storage market is enormous

According to a report by the Central Electricity Authority

(CEA) of India, it is predicted that by 2030, the demand for energy storage in

India will reach 60.63 GW/336.4 GWh, including pumped hydro storage of 18.98

GW/128.15 GWh and electrochemical storage of 41.65 GW/208.25 GWh.

In recent years, the Indian government has introduced a

series of incentives aimed at promoting the development of new energy storage

technologies. In September 2023, the Indian government approved a scheme called

the Viability Gap Funding (VGF) program, which provides a subsidy of 40 per

cent of the deployment costs for the winning bidders of energy storage projects

through competitive bidding, aiming to reduce the deployment costs of energy

storage.

Additionally, the Indian government has allocated funds to

support the deployment of approximately 4 GWh of battery energy storage

systems, primarily targeting distribution companies, with winning projects

required to be operational within 18 to 24 months.

Interact Analysis’ recent report PCS in battery energy

storage systems forecasts that by 2030 India is poised to become the world’s

third-largest electrochemical energy storage market, particularly within

large-scale energy storage technologies such as wind-solar hybrid systems.

The lithium-ion

battery market in India faces limited production capacity.

With the gradual expansion of the electric vehicle and energy

storage markets in India, the Indian battery market is facing numerous

challenges and is unable to meet the demands of businesses.

Firstly, the domestic market lacks raw materials. India does

not possess abundant lithium mining resources. According to data from the

Indian Ministry of Commerce, from April to December 2023, India imported

lithium ores worth $25.5 million, with imports from China accounting for 61.8

per cent. It wasn’t until 2023 that India discovered lithium deposits

domestically for the first time. Simultaneously, India is actively seeking

international cooperation to acquire more mineral resources. In January 2024,

the Indian state-owned company KABIL signed a significant lithium exploration

agreement worth 2 billion rupees with the Argentine state-owned mining company

CAMYEN. Both parties will conduct lithium exploration activities in five blocks

in Argentina.

Secondly, while domestic battery pack production has been

rapidly expanding, the production capacity for battery cells remains relatively

limited. Among the top ten battery companies globally, only Samsung SDI has a

cell manufacturing facility in India with a capacity of 2 GWh, primarily

catering to the consumer electronics market. In recent years, numerous

companies such as Gotion, Sunwoda and Phylion have entered the Indian market

and established pack assembly plants. With the widespread application of

lithium-ion batteries in automotive propulsion, domestic manufacturers of

electric two-wheelers and three-wheelers in India have also begun transitioning

from traditional lead-acid batteries to lithium-ion batteries as their power

source. However, due to the relatively small domestic battery production

capacity, India still relies mainly on imports to meet market demand. According

to data from the Indian Ministry of Commerce, from April to December 2023,

India imported lithium-ion batteries worth $22.5 million, with imports from

China accounting for 84.5 per cent and imports from South Korea accounting for

10.8 per cent.

The Indian government

is actively promoting the localisation of battery cell production

To meet the growing market demand and reduce dependence on

imports, the Indian government is actively promoting the localisation of

battery cell production to enhance domestic battery capacity. In 2021, the

Indian government officially included the Advanced Chemistry Cell (ACC) project

in the Production Linked Incentive (PLI) scheme, allocating 181 billion rupees

to incentivise battery companies to localise production in India through

subsidies. The planned production capacity is set to reach 50 GWh.

This incentive policy has proven effective. The first round

of bidding for the ACC PLI concluded in March 2022, with three Indian companies

securing a total capacity of 30 GWh: Ola Electric Mobility Pvt Ltd, an Indian

electric vehicle company, obtained 20 GWh, while Reliance New Energy Ltd and

ACC Energy Storage, a subsidiary of Rajesh Exports, each secured 5 GWh. These

companies will establish factories in Krishnagiri, Tamil Nadu; Jamnagar,

Gujarat; and Dharwad, Karnataka, respectively.

Starting from 2023, more domestic Indian companies and

businesses from Korea and Japan have announced plans to build battery

gigafactories in India. Panasonic plans to construct a 20 GWh factory, while LG

Energy Solution and Indian steel conglomerate JSW plan to jointly build a 20

GWh facility. Tata Group’s battery subsidiary, Agratas, announced plans to

build a 20 GWh capacity factory in Gujarat. JSW has also announced an investment

of nearly $5 billion in the eastern Indian state of Odisha to build electric

vehicle and 50 GWh battery projects.

Moreover, the second round of bidding for the ACC PLI

commenced in January 2024, and it is expected that more companies will receive

capacity allocations, further driving the development of India’s battery indust

Final Conclusion

Countries and regions undoubtedly wish to build domestic

supply chains, reduce dependence on imports and avoid falling behind in terms

of industrial development. In Southeast Asia, countries like Thailand, Vietnam,

and Indonesia have seen numerous electric vehicle and battery manufacturers

actively expanding their presence, fostering a vibrant new energy industry. The

Indian government announced a reduction in import tariffs for electric vehicles

on March 15: vehicles priced above $35,000 will enjoy a 15 per cent reduction

in import duties over five years. Additionally, companies committing to invest

over $800 million will have a total import quota of 40,000 electric vehicles,

with 8,000 vehicles permitted annually. This sends a positive signal, creating

a more favorable environment for the domestic battery industry.

About the Author -

Yvonne

Zhang is a Research Associate at Interact Analysis. Yvonne joined Interact

Analysis as a Research Associate to assist the research team with organising,

interpreting findings, and enhancing product outputs. She has a master's degree

in Finance and has research experience in the Industrial Automation sector

after her studies in the United States.

Related Stories

Indian manufacturing sector: Negotiating its way in a less VUCA world

India’s manufacturing sector is evolving through policy support, technology adoption and sectoral growth, though challenges in R&D and skilling remain, writes Prof R Jayaraman, Head, Capstone Proj..

Read more

India’s Manufacturing Reset in an Uncertain World

Global manufacturing is being reshaped by volatility and disruption. This release outlines how India is strengthening depth, resilience and capability to emerge as a long-term manufacturing partner,..

Read more

New Opportunities in EV Manufacturing Amid Market Flux

India’s EV journey is entering a decisive phase, shifting from policy-led adoption to a focus on manufacturing depth, technology ownership, indigenisation and global competitiveness, shares Dr Uda..

Read moreRelated Products

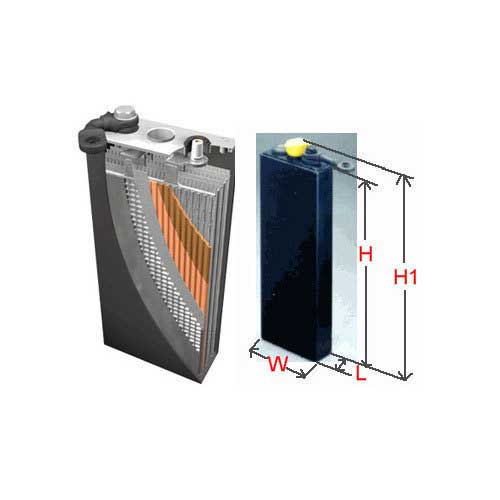

Forklift Battery

Aatous International is a manufacturer and solution provider of a wide range of forklift battery.

Kusam Meco -Wrist Type High Voltage Alarm

‘KUSAM-MECO’ has introduced a new wrist Type High Voltage Alarm Detector - Model KM-HVW-289 having a wide sensing range from 1kV-220 kV AC.

Servotech Power Systems files 2 patents for energy management technologies

Servotech Power Systems, a leading manufacturer of EV chargers and solar solutions, has announced that it has filed two patents for innovative energy management technologies in order to facilitate gri Read more