Schedule a Call Back

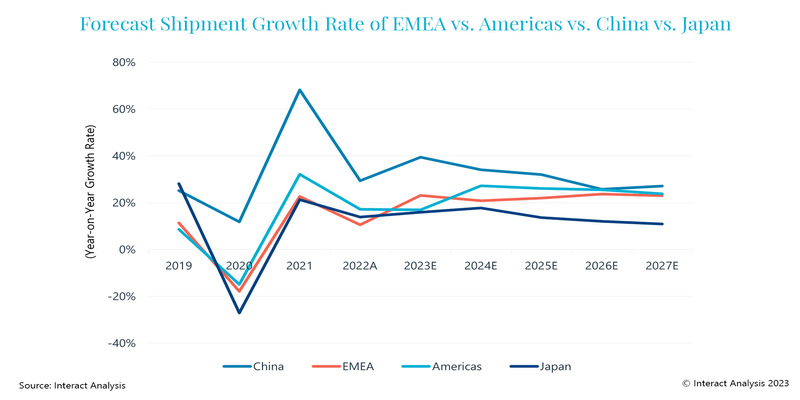

Cobot market to see growth at 20% by 2023

Industry News

Industry News- May 23,23

Related Stories

Bharat Forge Reports Strong Sequential Growth in Q3 FY26

Bharat Forge Limited posted 7.0 per cent sequential revenue growth in Q3 FY26, supported by strong domestic automotive performance and defence order execution.

Read more

Where Global Wire and Tube Innovation Comes Together

The world’s leading wire and tube trade fairs return to Düsseldorf, uniting global innovators to showcase AI-driven manufacturing, advanced materials and solutions shaping the future of industria..

Read more

Why Batteries Trail Strategy in Humanoid Robot Development

Battery makers are racing ahead of robot OEMs in positioning humanoids as the next growth frontier. This press release examines developments from both perspectives and considers how deeper cross-ind..

Read moreRelated Products

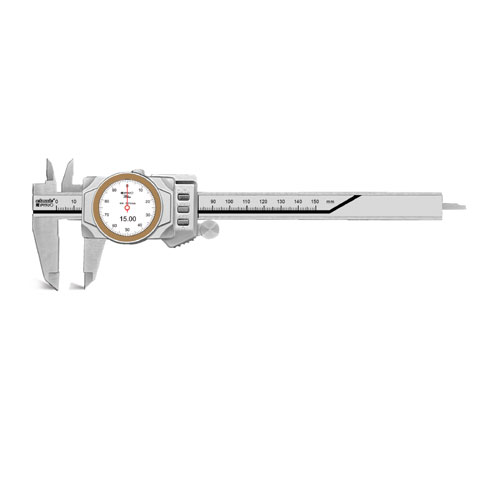

Digimatic Smart Caliper

Veekay Industries offers a wide range of digimatic smart caliper.

Compact Fmc - Motorum 3048tg With Fs2512

Meiban Engineering Technologies Pvt Ltd offers a wide range of Compact FMC - Motorum 3048TG with FS2512.

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.