Schedule a Call Back

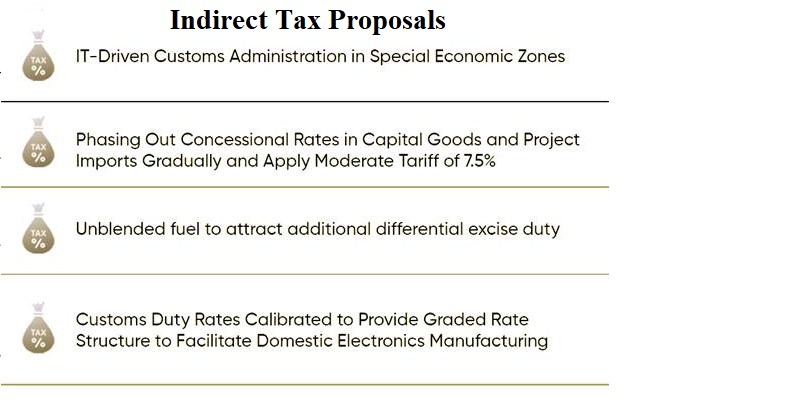

Budget 2022 - Customs duties rejigged to promote Make in India & exports

Industry News

Industry News- Feb 01,22

Related Stories

India’s Manufacturing Mission: What Make in India Got Right and Wrong

A decade after its launch, Make in India shows sectoral progress but structural gaps remain. As global manufacturing turns VUCA, the next phase must focus on value addition, jobs and ecosystems, say..

Read more

India–EU FTA: Gains on Paper, Tests on the Ground

The India–EU Free Trade Agreement expands market access across goods, services and mobility, but its impact will hinge on regulatory alignment, carbon costs and execution, writes Rakesh Rao.

Read more

Why Electronic Components Are Central to India’s Electronics Ambitions

India’s electronics push is shifting decisively from assembly to components, backed by the Union budget's higher ECMS outlay and ISM 2.0 to deepen value addition and resilience. The promise is rea..

Read moreRelated Products

Auto Wheel Hub Bearings

Kasuma Auto Engg Pvt Ltd offers a comprehensive range of Auto Wheel Hub Bearings.

Gear Lever Kits

B S Industry offers a wide range of gear lever kits.

Automotive Gear

Matrix Precision Engineering offering a personalized array of automotive gear.