Schedule a Call Back

Aatmanirbharta energising capital goods manufacturing

Industry News

Industry News- Feb 23,22

The pandemic induced a global economic slowdown with a severe economic contraction of 2.5 per cent in 2020. However, the situation improved in 2021, and the trend is expected to continue in 2022. The Governments around the world had to combat the unprecedented crisis that needed quick and effective redressal. While global trade was already affected by the ongoing US-China trade war, the pandemic deepened this mistrust, and the disruption of supply chains severely affected the manufacturing networks. The shock caused by it prompted several countries to contemplate a protectionist stance. The Governments tried to reorganise their supply chain networks and adopted policy measures to boost local manufacturing and production.

The Indian Government has also introduced several policy initiatives to aid the lurching economy. The Hon'ble Prime Minister announced a Rs 20 lakh crore economic package in May 2020 to pull the country out of the crisis and make it self-reliant. However, self-reliance here should not be construed as a self-centred ecosystem. The aim was to localise the supply chain to reduce dependence on imports while becoming efficient enough to improve our exports. The AatmaNirbhar Bharat Abhiyan and several other contributing factors have helped India chart a course correction despite the prevalence of the pandemic. It is rapidly mitigating the impact and resuming its growth patterns.

India to become the fastest growing economy

Several rating agencies and world bodies including, the International Monetary Fund (IMF), pegged the Indian economy to grow at the fastest rate in 2021. The IMF projected that India would grow at a rapid rate of 11.5%, leaving behind China which was projected to grow at 8.1%. The massive second wave of COVID-19 ravaged the growth prospects of the Indian economy by several counts. India was on the revival path; however, the unprecedented rise in COVID cases in some areas forced the State Governments to impose restrictions that affected commercial activities. The IMF scaled down its growth projections for India by 2% and pegged it down at 9.5% after the second wave. However, it revised its growth projections for 2022 from 6.8% in January 2021 to 8.5%.

Meanwhile, the National Statistics Office (NSO), an undertaking of the Ministry of Statistics and Programme Implementation, has predicted that the Indian economy would grow at the rate of 9.5% in FY22, after a sharp contraction of 7.3% GDP in FY 21, due to the impact of COVID-19.

The reduced economic activities in 2020-21 pulled the manufacturing sector's growth down by 7.2%. However, heightened investment activity in the country has emerged as a silver lining for the manufacturing sector. According to the Department for Promotion of Industry and Internal Trade (DPIIT), cumulative FDI inflows in the manufacturing subsectors amounted to $ 100.35 billion between April 2000 and June 2021. An IBEF data indicates that the country witnessed a 15% increase in foreign direct investments in the first half of 2021. Several factors including, the rapid vaccination programme (reaching the milestone of 1 billion mark), have subsided the threat of COVID-19 and encouraged global manufacturing giants to invest in India.

Manufacturing sector: The key to AatmaNirbhar Bharat

The Indian manufacturing sector is emerging as one of the high growth sectors. The Government initiatives of improved ease of doing business, coupled with a continued augmentation of infrastructure and skilled human resources, can support the surge in manufacturing activities in the coming years.

The government had launched the 'Make in India' programme to place the country on the manufacturing world map. It has been actively aiding the sector to increase its global recognition. The Gross Domestic Product (GDP) share of the manufacturing sector, presently pegged at 15-16%, would cross the 25% mark if it can cash in on the initiatives under the 'Make in India' programme. The sector may prove to be a prominent contributor towards the nation's ambitious goal of becoming a five trillion dollar economy by reaching its potential of one trillion dollars by 2025.

Further, the manufacturing sector could become a larger and more crucial part of the global economy by exploiting the preferable propositions under the AatmaNirbhar Bharat Abhiyan (i.e. Self-reliant India mission). The policies under the mission are directed to make India a more efficient, competitive, resilient, self-sustaining and self-generating economy. India, with its largely untapped human resource, can fill the gap created by the disruption in global supplies. With increased emphasis on skill development, the country can create an army of skilled workforce that can cater to the growing demand.

The manufacturing sector comprises process industries such as food, metal, rubber, and oil refineries, chemicals, petrochemicals related products etc. as well as the capital goods industry. The capital goods industry contributes 12% to the total manufacturing sector in India and 1.8% to India’s GDP. Growing industrialisation and economic development will drive demand growth in the capital goods market. It is forecasted to grow to $ 115 billion by 2025.

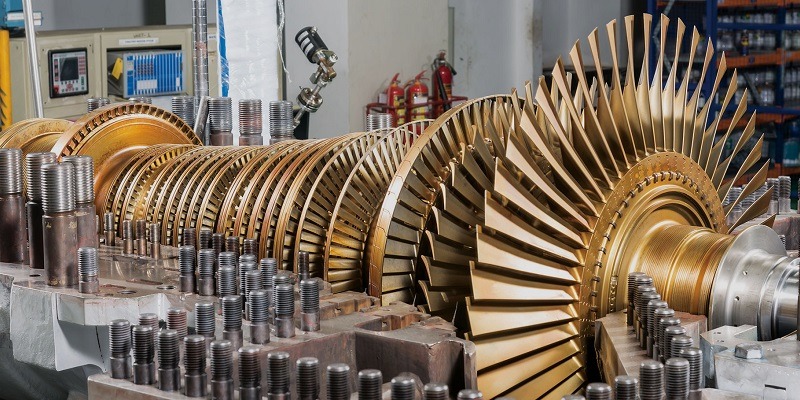

Capital goods are those that are used in the production of other products. These include heavy engineering segments such as machine tools, industrial machinery, textile machinery, printing & packaging machinery, process plant equipment, construction & mining equipment etc., light engineering segments, heavy electrical equipment (such as boilers, turbines, generators, transformers, switch gear & control gear) and automotive products.

Opportunity in adversity

Sustained economic growth continues to drive electricity demand in India. Propelled by the economic growth, overall industrialisation and urbanisation over the past few years, the country's energy requirements witnessed a drastic upswing. According to the Central Electricity Authority (CEA)- Ministry of Power, the per capita consumption of electricity in March 2020 was 1,208 kWh; it has grown to 1,238 kWh per capita as of March 2021. This consumption ratio is bound to increase with the Government's ambitious universal access to electricity plan.

The country is aiming at 24x7 power for all, and to realise this, it is continuously increasing its power generation capacity. The total installed power generation capacity of India in November 2021 was 392GW. The country added 22 GW capacity since March 2020, when it was generating a cumulative total of 370 GW.

According to the 19th Electric Power Survey conducted by Central Electricity Authority (CEA), the all-India installed power generation capacity is projected to grow to 619 GW by the end of March 2027. However, the International Energy Agency (IEA) estimates indicate that India will add between 600 GW to 1,200 GW of power generation capacity before 2050.

It is envisaged that in 2050, India will have an annual energy demand of about 14,500 TWh per year. The industries followed by the transportation and infrastructure sector would create most of this demand.

India’s electrical equipment industry has witnessed significant growth in the last few years. It would continue to grow significantly in the future to cater to the increasing demand for power generation capacity. Raised government spending on rural and household electrification schemes and programs to improve power distribution will drive the demand for power generation (boilers, turbines and generators), transmission and distribution equipment in India. The capital goods manufacturing industry needs to scale up its efforts to cater to this growing requirement.

On 22 July 2021, the Government announced a production linked incentive scheme for manufacturing speciality steel that helps in producing capital goods like turbines and boilers. This financial support would help the sector with increased availability of speciality steels which is a crucial input for the production of turbines and boilers. It would reduce the industry's reliance on imports, and increase their efficiency and productivity that would help them in catering to the growing domestic demand. Further, if the Indian capital goods manufacturers intend to become self-reliant, they need to invest in the research and development processes. Through this investment, they would be able to bring innovative technologies to the fore, which would help them in developing and retaining a competitive edge in the global market.

The Indian capital goods industry has garnered new opportunities in the form of import substitution and new export opportunities. They need to cash in on the reduced competition and strive to establish themselves as the global supply hub, a space created after the sudden disruption in the existing supply chain network. India along with several other countries was highly dependent on China for sourcing their manufacturing inputs. The manufacturing segment needs to step up to this opportunity and rapidly grow its potential to become self-reliant and emerge as an alternative supply route for industries across the globe.

About the author:

Arun Mote is the Executive Director & CEO of Triveni Turbines. Under his leadership, the turbine business has turned around and has grown many times and established leadership in industrial turbines in domestic and also in overseas market. Prior to Triveni Turbines, he has worked with companies like L&T, SKF Bearings, Caterpillar, Blue Star, etc.

Related Stories

Raghu Vamsi launches DeepTech plant, Unveils UAVs India Asia

Raghu Vamsi Aerospace Group announced a new DeepTech facility near Hyderabad and unveiled six India-made UAV and autonomous defence systems, backed by over Rs 1 billion investment, strengthening sel..

Read more

Raghu Vamsi launches DeepTech plant, Unveils UAVs India Asia

Raghu Vamsi Aerospace Group announced a new DeepTech facility near Hyderabad and unveiled six India-made UAV and autonomous defence systems, backed by over Rs 1 billion investment, strengthening sel..

Read more

Greenfuel Launches Ferrule-less Tube Line to Boost Make in India

Greenfuel Energy Solutions opens a new ferrule-less tube line in Manesar, enhancing local manufacturing, technology transfer, and alternate-fuel vehicle support.

Read moreRelated Products

Integrated Electric Gripper S Series

IBK Engineers Pvt Ltd offers a wide range of integrated electric gripper S series.

Geared Electric Motors

Delco Fans Pvt Ltd offers single phase capacitor run and three

phase geared Instrument motors, totally enclosed face/foot mounted.

“Kusam-Keco” Partial Discharge Acoustic Imager - Model - Km-pdai

‘Kusam-Meco’ has introduced a new “Partial Discharge Acoustic Imager Model KM-PDAI.