Schedule a Call Back

Wastewater treatment: Converting waste into resources

Technical Articles

Technical Articles- Oct 01,17

- >> Urban and industrial India will have huge implications on the use of water and discharge of waste

- >> Cities worry about water, but not the waste this water will generate

- >> The challenge of sewage collection and treatment has not received adequate attention

- >> No Indian city is in a position to boast of a complete sewerage system, which can keep up with the sanitation and pollution challenge

- >> The capital intensity of the current waste system results in the fact that cities can only provide for a few and not for all

- >> If sewage systems are not comprehensive – spread across the city to collect, convey and intercept waste of all – then pollution will not be under control

Related Stories

Vipul Organics forays into membrane manufacturing

The company will build a separate facility for membrane manufacturing at its greenfield project at Saykha, Gujarat.

Read more

Schneider Electric automates single stage wastewater treatment plant

The project supports the Namami Gange initiative for enhancing water quality in the country through smart, sustainable and digital solutions.

Read more

Daftech Engineers' focus for 2024-25 will be Latin America

In this interview, Shaju Peter, Marketing Director, Daftech Engineers Pvt Ltd, highlights the importance of dissolved air flotation (DAF) clarifier in treating wastewater and green manufacturing.

Read moreRelated Products

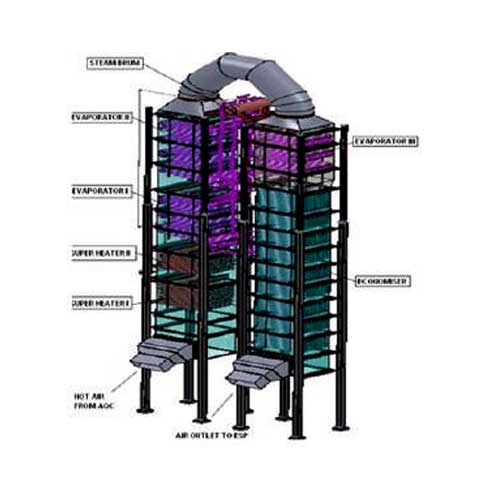

Waste Heat Recovery Boilers

Sitson India Pvt Ltd offers a wide range of waste heat recovery boilers.

Reinforced Water Activated Paper Tape

Mexim Adhesive Tapes Pvt Ltd offers a wide range of reinforced water activated paper tape.

Hot Water System

Haadi Enterprises offers a wide range of hot water system, solar. Read more