Schedule a Call Back

Infra-led growth driving demand for construction equipment

Articles

Articles- Oct 01,18

Related Stories

India’s Decarbonisation Journey: Turning Climate Challenge into Opportunity

While decarbonisation is increasingly becoming a prerequisite to access premium global markets, India's path to net-zero by 2070 is complex. However, with coordinated action, strategic investments, ..

Read more

HCC Secures Rs 2,040 Mn Deal for Fabrication in Hindalco’s Odisha Expansion

HCC’s advanced fabrication expertise and execution capabilities will be crucial in delivering this large-scale industrial project to international standards.

Read more

SANY India Opens New 3S Branches in Visakhapatnam and Palwancha

The inauguration ceremonies were attended by senior leaders from SANY India.

Read moreRelated Products

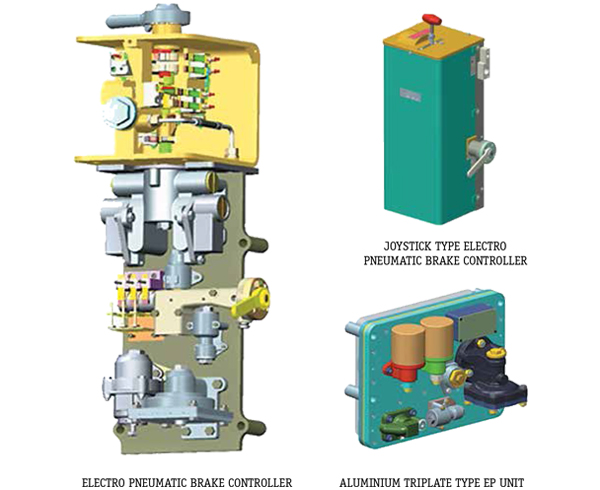

Electro - Pneumatic Brake System for Emu

Escorts Kubota Limited offers a wide range of electro - pneumatic brake system for EMU.

Indef Powered Crane Kit

Hercules Hoists Ltd offers a wide range of Indef powered crane kit.

Jib Crane

DC Hoist & Instruments Pvt Ltd offers a wide range of Jib crane.