Schedule a Call Back

Hydraulic excavators: Pushing new boundaries

Technical Articles

Technical Articles- Jul 01,18

Related Stories

Coal India September Output Drops 3.9% to 48.97 MT Amid Monsoon Impact

Coal production for the April–September period also declined to 329.14 MT.

Read more

LAPP India Strengthens Cable Gland Product Offering with SKINTOP Range

SKINTOP cable glands - SKINTOP ST/STR and SKINTOP SMART - will be locally manufactured at LAPP’s Dharuhera facility for varied industrial applications.

Read more

Coal India and UPRVUNL to build 500 MW solar plant

Last month, CIL had also signed a pact with Damodar Valley Corporation (DVC) to set up a Rs 165 billion ultra-supercritical thermal power plant in Jharkhand, emphasising its commitment to high-effic..

Read moreRelated Products

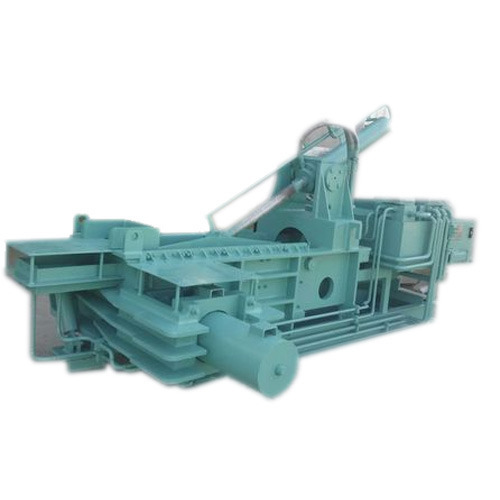

Baling Machine

Mask Hydraulic Machineries provide triple action scrap baling machines. Read more

Manifold Block

Om Shakthi Hydraulics offers a wide range of hydraulic manifold blocks. Read more

Exclusive Hydraulic Fittings

Supreme Engineers is engaged in manufacturing and supplying an exclusive range of hydraulic fittings. Read more