Schedule a Call Back

Fluid power market witnessing spur in demand

Technical Articles

Technical Articles- Nov 01,17

Related Stories

Global hydraulics market thrusts upward

Infrastructure development remains one of the most significant growth drivers for the hydraulics market. Governments and private sectors worldwide are investing heavily in urbanisation, smart cities..

Read more

John Cockerill and Electro Pneumatics sign JV to strengthen India’s defence system

The JV will focus on manufacturing, assembling, and commissioning turrets for the Indian Army’s Indian Light Tank (I.L.T) program, a critical initiative aimed at enhancing India’s defence capabi..

Read more

Celeros’s Plenty Triro pumps deliver optimum oil performance

The axial pulse-free pumping action used by the Plenty Triro means there are no pulsing hydraulic shock characteristics.

Read moreRelated Products

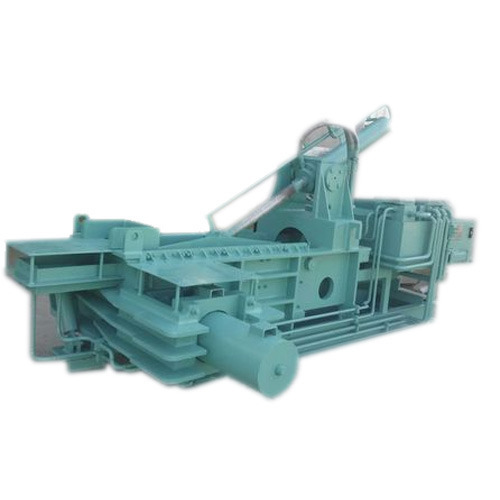

Baling Machine

Mask Hydraulic Machineries provide triple action scrap baling machines. Read more

Manifold Block

Om Shakthi Hydraulics offers a wide range of hydraulic manifold blocks. Read more

Exclusive Hydraulic Fittings

Supreme Engineers is engaged in manufacturing and supplying an exclusive range of hydraulic fittings. Read more