Schedule a Call Back

Existential crisis looms over container freight stations this fiscal year

Industry News

Industry News- Apr 18,18

Related Stories

C and C Laser Engineering Pvt Ltd (CnC) delivers precision laser marking, engraving and processing systems for industrial and craft applications.

CnC offers advanced CO?, fibre and UV laser processing solutions

Read more

Danfoss, PowerNEU Launch JV to Drive Decarbonisation in Metals Sector

New Danfoss PowerNEU JV in Jamshedpur strengthens local execution and decarbonisation solutions for India’s metals industry.

Read more

Phoenix Contact: A reliable power solutions provider for machine building

Key benefits of Phoenix Contact solutions include: Reduced operational complaints, early fault detection, lower downtime and increased system availability, and real-time power and system monitoring.

Read moreRelated Products

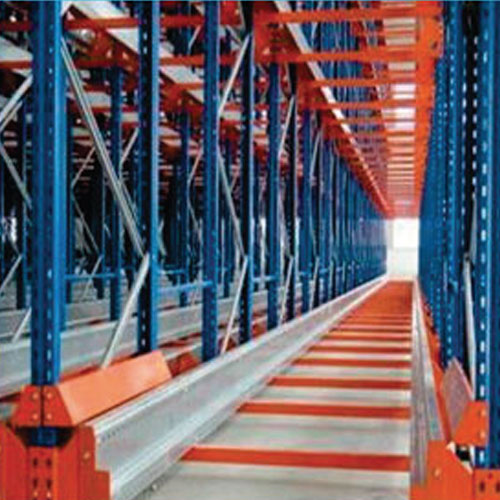

Pallet Shuttle Racking

SCI Storage Solution offers a wide range of pallet shuttle

racking.

Gravity Flow Pallet / Shelving Racking

SCI Storage Solution offers a wide range of gravity flow

pallet / shelving racking.

Auto Transformer

HCS Power Ventures Pvt Ltd offers Auto Transformer. Servottam Autotransformer is an electrical transformer with only one winding. The "auto" prefix refers to the single coil acting on itself and no Read more