Schedule a Call Back

Automotives is the largest consmer of industrial paints

Articles

Articles- Sep 16,19

Related Stories

NIIST develops anti-corrosive coat from the mango leaf extracts

This new development will be a huge boon to the natural coatings development.

Read more

Automotives is the largest consmer of industrial paints

With industrial paints, coatings and varnishes sector has experienced a shift from unorganised to the organised market with the GST introduction and aimed for a better market due to GST cut.

Read moreRelated Products

Polysiloxane Anti Corrosion Coating

Clean Coats offers polysiloxane anti corrosion coating.

Powder Coating Services

Jekmin Industries offers a wide range of powder coating services Read more

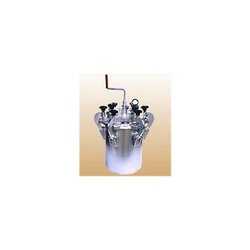

Painting Equipments

We are a renowned manufacturer and supplier of a wide range of Blasting and Painting Machines, Testing Instruments and Abrasive Products. The products offered by us are manufactured using high-grade r Read more