Schedule a Call Back

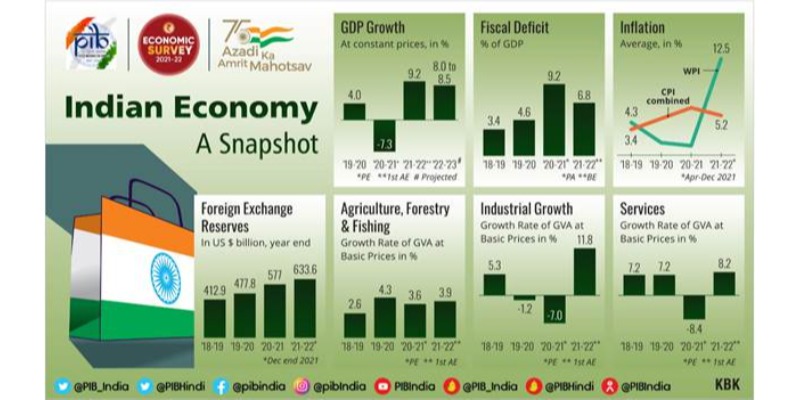

Budget 2022 - Economic Survey: Industrial sector to expand 11.8% in 2021-22

Industry News

Industry News- Feb 01,22

Related Stories

EFTA Commits $100 Billion Investment in India: Goyal

Goyal says EFTA to invest $100 billion in India’s innovation and manufacturing.

Read more

India’s GDP Rises 8.2% in Q2 FY26 as Manufacturing Recovers

Economists lift forecasts as manufacturing and services drive strong GDP growth.

Read more

How trade wars and geopolitics are reshaping India’s growth story

India’s journey through the turbulence of trade wars and geopolitical conflicts is as much about resilience as it is about ambition. Rahul Bhandurge, Director - Sales & Business Development, BDB I..

Read moreRelated Products

Heavy Industrial Ovens

Hansa Enterprises offers a wide range of heavy industrial ovens.

High Quality Industrial Ovens

Hansa Enterprises offers a wide range of high quality industrial ovens. Read more

Hydro Extractor

Guruson International offers a wide range of cone hydro extractor. Read more