Schedule a Call Back

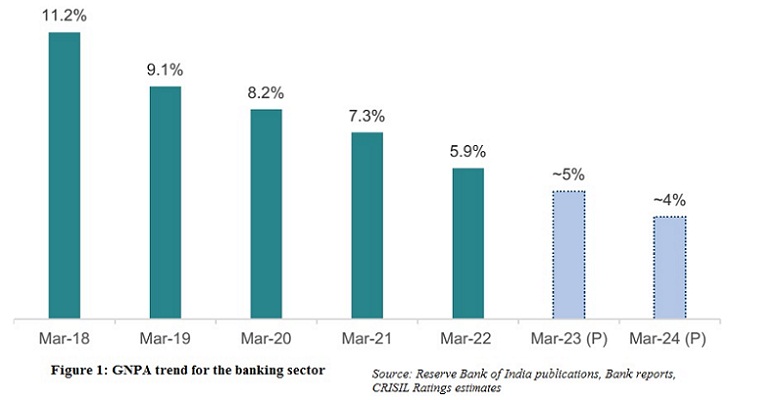

Bank GNPAs may touch low of 4% by FY24; MSMEs remain a concern area

Industry News

Industry News- Sep 29,22

Related Stories

Tech-Enabled Intra-City Logistics Boost MSME Efficiency

A C-DEP–IIT Delhi study shows how technology-enabled intra-city logistics is cutting costs, improving delivery reliability and expanding market reach for MSMEs, while flagging key GST and policy r..

Read more

Budget 2026 sharpens focus on manufacturing scale-up across strategic sectors

Union Budget 2026–27 advances manufacturing-led growth with sectoral schemes, higher outlays and supply-chain reforms.

Read more

Budget 2026–27 targets MSMEs with Rs 100 billion boost and TReDS push

Budget rolls out a Rs 100 billion MSME fund and TReDS reforms to improve equity, liquidity and compliance.

Read moreRelated Products

Heavy Industrial Ovens

Hansa Enterprises offers a wide range of heavy industrial ovens.

High Quality Industrial Ovens

Hansa Enterprises offers a wide range of high quality industrial ovens. Read more

Hydro Extractor

Guruson International offers a wide range of cone hydro extractor. Read more