Schedule a Call Back

GST provided a much required boost to Indian SMEs

Interviews

Interviews- Aug 01,18

Related Stories

Markem-Imaje opens thermal transfer printing lab in Bengaluru

The facility features cutting-edge testing and R&D capabilities, reinforcing Markem-Imaje’s leadership in delivering reliable and sustainable printing solutions.

Read more

How MSMEs will play a key role in the development of Indian manufacturing sector

Setting up a business in India is futuristic, makes a lot of sense, and, for foreign companies, connecting with the Indian MSME and helping it grow is a sure way to success, says R Jayaraman.

Read more

Zetwerk eyes $1 billion IPO to boost growth

The company’s platform facilitates connections between suppliers and clients across industries, including aircraft engine manufacturing, consumer electronics, and home appliances.

Read moreRelated Products

Standard Series Stations and Enclosures

Esbee

Industrial Combines/Esbee Electrotech LLP offers standard series stations and

enclosures.

Fire Alarm

Safe Zone is prominent traders and suppliers of the industry, offering a wide range of wireless fire alarm.

Read more

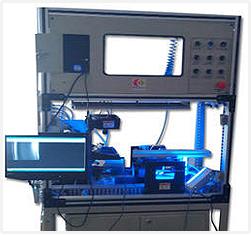

Sorting Automation Systems

Renovus Vision Automation offers sorting automation systems.

Read more