Schedule a Call Back

The future of compressed air business

Technical Articles

Technical Articles- May 02,18

_.gif)

- Life cycle cost: The customer needs to be aware of a compressor’s lifecycle cost, which includes the initial machine cost, energy consumption, spares and maintenance cost, and the revenue loss from a downed compressor. The largest portion is the power cost. Thus, manufacturers need to tackle the challenge of continuous improvement in compressor efficiency.

- Oil-free air: The majority of of compressors use oil while generating compressed air, placing a burden on the environment. The current oil free compressors are expensive and inefficient, and are thus relegated to applications such as the pharmaceuticals and food manufacturing industries. Thus, the challenge for a manufacturer is to develop a system that produces oil free air at the efficiency and cost of a lubricated screw compressor.

- Uptime reliability: Reliability is an often overlooked attribute. Specifically, customers focus on the cost of parts and service in the event of a breakdown, but the larger cost derives from the cost of lost production. Thus, customers should assess the products’ track record of reliability and the manufacturer’s ability to restore air in the event of a breakdown. Technology offers a solution to minimize the cost of downtime. Soon, machines will be launched with data transmission capabilities that will allow engineers to monitor compressor health across parameters such as temperature, pressure loss, etc. and thus prevent machine failures.

Related Stories

Danfoss India plans to accelerate localisation of HVACR compressors and controls

The decision to invest in ramping up local manufacturing capabilities in India will help minimise the company’s dependency on imports for the Indian market.

Read more

"Elgi Equipments sees growth in vacuum technology market."

In this interview with Rakesh Rao, Dr Jairam Varadaraj, Managing Director, and Anvar Jay Varadaraj, Chief Operating Officer, of Elgi Equipments Ltd, elaborate on the company’s future plans and ind..

Read more

Elgi Equipments releases Q4 FY24-25 results

The company, on a consolidated basis posted a PAT of Rs 947 million for the quarter, compared to a PAT of Rs 913 million in the same period in 2023-2024, representing a growth of 4%.

Read moreRelated Products

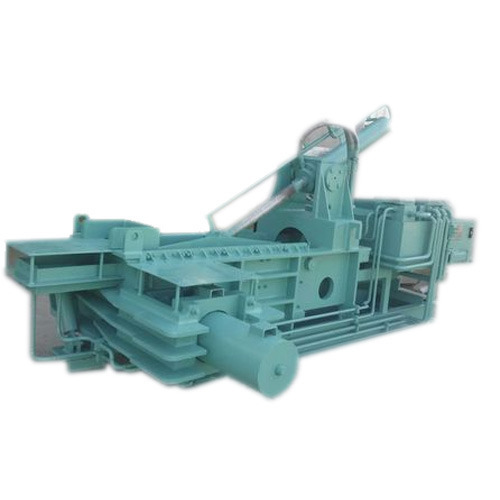

Baling Machine

Mask Hydraulic Machineries provide triple action scrap baling machines. Read more

Manifold Block

Om Shakthi Hydraulics offers a wide range of hydraulic manifold blocks. Read more

Exclusive Hydraulic Fittings

Supreme Engineers is engaged in manufacturing and supplying an exclusive range of hydraulic fittings. Read more